The Emerging Geography of AI: Introducing the Top-Ranked AI Nations (TRAIN) Scorecard

As the Global AI race intensifies, we mapped emerging AI leadership across data, rules, capital, and innovation.

We are staring at an employment crisis, which could get worse. But with policy support that could change.

Check out the latest research insights, analyst spotlights, and news from Digital Planet.

Regulatory panic could do more harm than good. Rather than poor risk management today, rules should anticipate the greater risks that lie ahead.

In 2023, AI's breakthrough led to Big Tech dominance. Regulators, aiming to protect, unintentionally fueled accelerationists' power, raising consolidation risks.

As competition intensifies in the global race for AI dominance, we mapped the emerging geography of AI leadership across four main drivers: data, rules, capital, and innovation.

AI power shifts globally impact prioritized applications, societal benefits, economic sectors, data for training algorithms, biases inclusion, and innovation versus safeguards balance. 25 nations compete for AI leadership.

In an exclusive interview with Business Insider Africa, representatives from Tufts Fletcher School, the Mastercard Center for Inclusive Growth, and Dalberg shared their perspectives on the critical challenges and opportunities facing Africa's youth in the realm of job creation

On the sidelines of the 78th UNGA, Digital Planet co-hosted a panel discussion with Mastercard on the opportunities and challenges in the digitalization of government programs and services and how public-private partnerships can deliver on the promise of a more transparent, inclusive, efficient, and resilient governance and help bridge the gap between citizens and governments.

India's economic rise seems promising with drivers like demand, supply, policy reforms, and geopolitics, but challenges remain.

Fuel African labor markets: Embrace digital shifts, empower 'systems

orchestrators,' drive growth for 375M job seekers.

In this interview, Bhaskar Chakravorti discusses the importance and future of digital public infrastructure with Hindol Sengupta.

Regulating artificial intelligence to protect U.S. democracy could end up jeopardizing democracy abroad.

As the Global AI race intensifies, we mapped emerging AI leadership across data, rules, capital, and innovation.

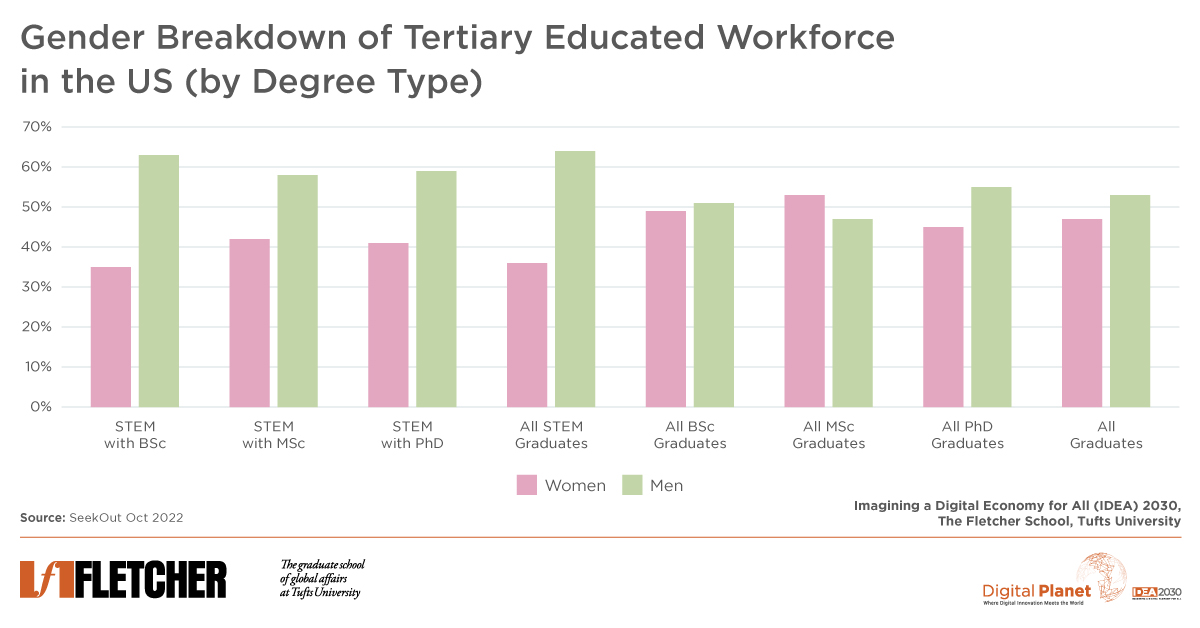

Women remain under-represented in high-paying technical and decision-making roles in STEM professions – a scenario that exposes the Achilles’ heel of the entire technology industry.

The under-representation of women in high-paying STEM roles is a vexing issue that exposes a systemic inertia across the industry.

We are staring at an employment crisis, which could get worse. But with policy support that could change.

The BRICS group exists in a symbiotic relationship with the Western-led global institutions while engaging in new economic initiatives. Yet it can only become a real alternative if it improves the conditions of the Global South.

Amid war, Ukraine's tech adapts: from service-led to aiding efforts & planning Smart Ukraine. SET's Iryna Volnytska trains women; Bhaskar Chakravorti studies the shift."

Regulatory panic could do more harm than good. Rather than poor risk management today, rules should anticipate the greater risks that lie ahead.

Deloitte & Fletcher School's study reveals strategies for enhancing investor trust in sustainability disclosures, highlighting the critical role of reliable data and the growing importance of sustainability in investment decisions.

In 2023, AI's breakthrough led to Big Tech dominance. Regulators, aiming to protect, unintentionally fueled accelerationists' power, raising consolidation risks.

Copyright © 2023. All rights reserved.

The Fletcher School of Law and Diplomacy, Tufts University