SIPRI today released their annual data on world military expenditure, covering 2016 (along with full data for 172 countries going as far back as 1949 in some cases). This causes me a little wave of nostalgia, as up to last year this was my job, before I moved to WPF. (I was still involved in the data collection and assessment, but the polishing, analysis and writing was all done by the rest of the team, including my able successor Dr. Nan Tian). But I felt I could not let the occasion pass without adding my own comments, although SIPRI’s excellent fact sheet, along with some excellent new visuals, as always covers most of the main points.

One set of figures catches the eye in particular, dramatically illustrating the relative decline of Western European countries as military powers: the list of the top 5 military spenders now reads USA, China, Russia, Saudi Arabia, India. (The latter barely pipping 6th place France by $200 million). The data does not go back far enough of course, but this is almost certainly the first time since the modern era of standing armies that no west European country has been among the top 5 spenders. Some would see this as a crisis that must be swiftly rectified; but I see no sign that European countries are poorer or less secure as a result. On the contrary, Europe has seldom been so peaceful. The challenges to European security are economic and political, not military.

Meanwhile, the headline figure for total world military expenditure is virtually unchanged in real terms (i.e. adjusted for inflation). In 2016 prices, the total is $1686 billion, while in constant 2015 prices, the figure increased marginally from $1682 billion in 2015 to $1688 billion in 2016.[1] In fact, the total has been pretty much steady since 2010, the end of a long period of sharply rising expenditure. World military spending in 2010 stood at $1695 billion (in 2015 prices), rose insignificantly to $1700 billion in 2011, then fell to a low point of $1664 billion in 2014—a fall of just 2.1%—before increasing slightly over the last two years.

However, these 6 years of ‘no change’ in the world total are the result of major, and changing, trends in different parts of the world, that have roughly cancelled each other out.

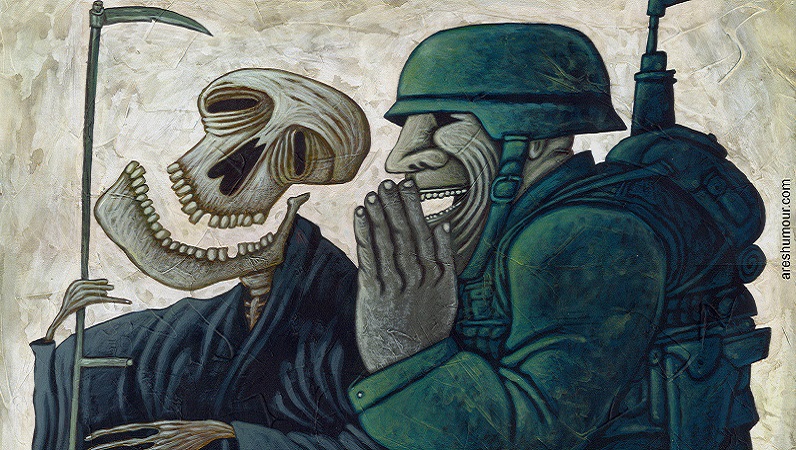

First, spending in the US and Western and Central Europe was falling for most of the period, but has now started to increase again. The US started to cut spending in 2011, as combat troops started to withdraw from Iraq and Afghanistan, and Congress enacted measures to reduce the budget deficit. But the fall in spending from 2010 to 2015, of about 21.5%, is far shallower than those at the end of the Viet Nam War or the Cold War, and is closer to the more limited retrenchment at the end of the Korean War. (A fall of 18% from 1953 to 1956). This is not surprising, because there has really been no “post-war” period; rather, a reduction in intensity of US wars, and a shift in focus. Just as the Korean war led to the beginning of a ‘permanent war economy’, and Eisenhower’s Military Industrial Complex, so the ‘War on Terror’ has become a Permanent War: barring a dramatic and unforseeable change in world circumstances or US thinking, the US will never be ‘at peace’ again.

Meanwhile, European spending in EU and NATO countries fell significantly from 2009 as a result of austerity policies following the global economic crisis, but renewed tensions with Russia following the Ukraine crisis started to push spending up again starting in 2015 (earlier in the Central European countries that are most fearful of Russia, and that had cut spending most). Now, the arbitrary NATO target of 2% of GDP for military spending by its members promises further increases.

A second key trend, pointed out by SIPRI, is military spending by oil-dependent countries. This was soaring for many years, but since the oil price crash in late 2014 has peaked, and now started to fall. Some countries, such as Russia and Algeria, have maintained increases (although Russia in particular will surely be forced to squeeze spending soon, and indeed it would have fallen were it not for a big one-off repayment of debt to the arms industry). But spending in many oil countries, including Saudi Arabia, Venezuela, Angola, South Sudan and Azerbaijan fell sharply in 2016, and in many cases also in 2015.

The link between oil, arms and corruption has been speculated on before, and this sharp up-and-down in military spending in response to oil price changes may support this. For example, raising and then slashing soldiers’ salaries in response to oil prices would not be a smart move by governments heavily dependent on military support. In some cases it may be a question of cutting back on arms purchases, but even so payments for major arms imports are not made all in one year, and payments for previous orders will have to continue.

But if a major role of military spending is to act as a highly opaque slush fund through which benefits can be distributed to the elite, whether through bribes on arms purchases, skimming off salaries for ghost soldiers, or issuing fake contracts for goods and services, then this is a much easier ‘luxury’ item to cut back in lean times.

Meanwhile, Asian military spending has just kept on steadily growing, on the back of strong economic growth and a gradual ramping-up of regional tensions. (One which the Trump regime threatens to put on steroids). Most, about 72%, of the $113 billion or 33% increase in Asia & Oceania since 2010 comes from China, but there have been increases, to a greater or lesser extent, by all countries in the region except Afghanistan, Fiji and Timor Leste. Among other major Asian powers, India’s spending is up 15% since 2010, and rival Pakistan’s by 38%, South Korea’s by 18%, and Australia’s by 14%.

But another increasing trend seems to be the uncertainty in military expenditure figures. This has always been a feature: we have always known that there’s a lot of off-budget military expenditure, especially on arms imports, and that some countries only report budget data rather than actual expenditure, which may differ significantly. As for China, estimating how much extra they spend on things like R&D and military construction outside the official defense budget has always been at best an educated guess. But some recent trends may have worsened this.

The wild swings in oil prices, and accompanying economic dislocations, are one factor. Some of the big oil countries, like Angola and Venezuela, only publish initial budget figures, which may be subject to greater than usual inaccuracies in this climate. This is especially true of Venezuela, where inflation from 2015 to 2016 was nearly 500%. These budget figures must therefore be treated with extreme caution, as it is highly likely that, for example, soldiers’ salaries had to rise significantly, at least in nominal terms, in response to such rampant price rises. The figure for Venezuela’s spending as a share of GDP, at 0.3%, is simply too low to be credible.

Another factor is conflict, which has led to a number of countries dropping off the map of military spending in recent years, such as Libya, Syria, and Yemen, probably due to total or near total state collapse. (In any case, the question of whose military spending to measure as being that of the ‘state’ would be a moot point in Libya and Yemen). Transparency has also worsened in some important countries. The UAE, recorded by SIPRI as the 14th highest military spender in the world (based on its 2014 spending) has stopped publishing information allowing for a reasonable estimate to be made since 2014—one of the main reasons why SIPRI has not attempted to make an estimate for the Middle East total for the past two years. (Although an implicit estimate can be derived by subtracting the other regions from the estimated world total—the uncertainties involved are considered too high a share of the Middle East total to make an estimate viable, but are a much smaller share of the world total).

So no change in total, but many signs that the forces pushing up military spending in many parts of the world are strengthening, while those that have led to dramatic falls in some countries—chiefly the delayed effect of the fall in oil prices—may well have already worked its way through.

[1] Why are these numbers for 2016 different? The 2016 prices are based on 2016 conditions, converting each country’s spending to US dollars using the average exchange rate for the year. The constant 2015 price figures mean “let’s pretend it’s 2015”. Adjust each country’s local currency figures for 2016 for the inflation rate in that country between 2015 and 2016, then convert to US dollars at the 2015 exchange rate. The current price, 2016 figures are the best for comparing two countries in 2016; the constant price figures are best for measuring changes over time.