The COVID-19 pandemic will, it is feared, bring about the most severe global recession for decades. It will also restructure the global economy. Some of these dynamics are already clear in the U.S., where big corporations with political influence in Washington DC are salivating at the prospect of being able to gobble up a bigger market share as the White House and Congress get their chance to pick the winners.

To date, Africa has been less hard-hit by the virus than developed countries, but it is already hard-hit by the economic crisis. This blog post provides some preliminary thoughts on how the recession and restructuring may unfold. It brings a political economy lens and compares today with the last continent-wide recession which occurred in the 1980s. Over the subsequent thirty years, Africa has not suffered a continent-wide recession, weathering the storms of the East Asian financial crisis and the global financial crisis remarkably well.

The 1980s recession in Africa was more than an economic downturn. It also restructured Africa’s political economies. For some countries it was the moment at which the political marketplace took root.

At the risk of over-generalization, the recession of the 1980s was caused by four main factors.

- Fiscal crisis, arising from domestic economic distortions and compounded by austerity/structural adjustment policies required by IFIs and creditors. (The quid pro quo was access to concessionary finance when economic policies were deemed sound.)

- Decline in commodity exports including low prices for oil. (In due course, prices rebounded.)

- Debt crisis, at a time when interest rates were high and debt rescheduling was the most that the Paris Club was willing to offer, (Later on, large scale debt relief was organized through HIPC.)

- Declining international aid coinciding with the thawing of the Cold War. (Aid was later expanded.)

The pressure on state budgets had the effect (desired by the proponents of structural adjustments) of removing the distorting effects of monopsonistic markets for agricultural products, subsidies for urban dwellers, loss-making parastatals and over-valued exchange rates. The beneficiaries were small producers, and businesses ranging from transnational corporations to informal sector entrepreneurs. Programs of privatizing state assets often led to the growth of crony capitalism as governments sold businesses cheaply to politically-well-connected individuals. In the meantime, natural adversities (drought) and armed conflict/predation brought about a wave of humanitarian crises.

The decline in state revenue meant that governments were required to undertake a massive process of triage, cutting back on social spending and even on defense and security spending. Governments facing insurgencies or other political crises turned to very short-term methods for raising resources (asset stripping and predation) and in extremis using self-financing units for regime stability and counter-insurgency (e.g. militia strategies). This meant that when the economic rebound came, in many cases the model of governance was transactional and mercenary—the birth of Africa’s ‘political marketplace’.

The HIV/AIDS epidemic reached its peak in Africa at the time of the economic rebound, including a huge expansion in ODA. The favorable international context was one reason why the HIV/AIDS epidemic did not have the feared calamitous economic consequences.

Today’s COVID-19 crisis unfolds in a context that warrants comparison with the situation of thirty years ago:

- Commodity exports: there is a marked decline that exacerbates the decline already evident over the last few years, and it is unlikely that market share and value will rebound quickly. (For agricultural products the picture is mixed.)

- Oil prices: these are now so low that some producers are likely to be permanently priced out of the market, and others will face long-term collapse in revenue. (This of course is a benefit for oil importers.)

- Debt: Africa has accumulated new debts to China, which currently shows no appetite for debt rescheduling or forgiveness programs, let alone measures comparable to HIPC.

- Remittances have increased as a key element in African economies and are being hard hit. This has a direct impact on the informal sector. Diaspora FDI is likely to be affected also.

- International financial assistance to African governments is in uncharted territory. On one hand, African economic governance is much improved in comparison to 30 years ago so their ability to access short term financial assistance should be greater. However, a coordinated program of global financial assistance on the scale required is unlikely, because of fractious global politics. The economics of pandemic bailout also confound the basic principles of financial rectitude that govern the IMF, which will need to be creative—and generous—in its response.

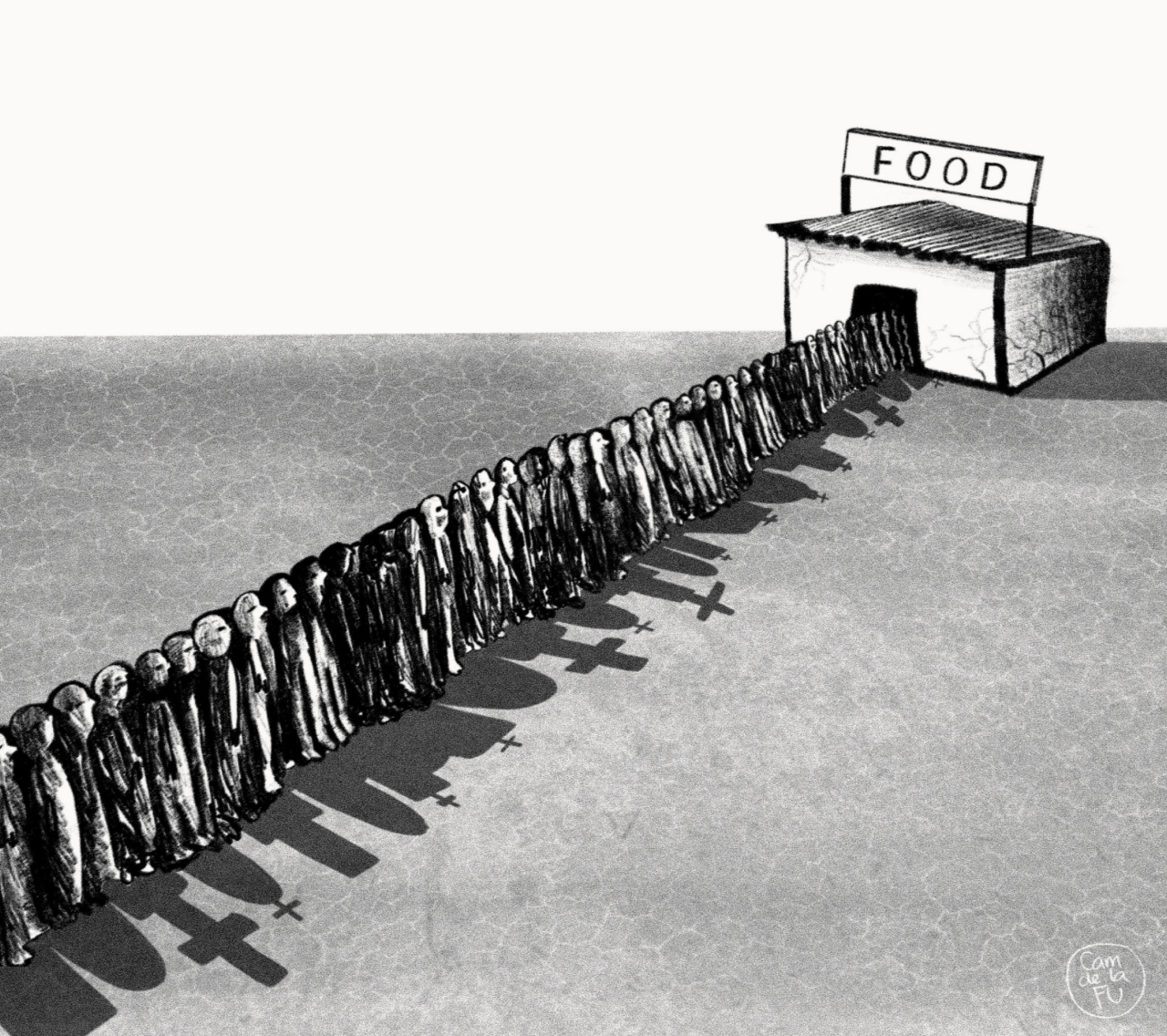

- The informal sector and local business are very hard hit by the COVID-19 related lockdown policies. This is a marked difference to the 1980s when the recession became an opportunity for local entrepreneurship and the informal sector had the capacity to absorb large numbers of people, albeit in extremely precarious jobs. Africa’s population has doubled in the last 30 years and jobs—formal and informal—are not commensurate today or in the forseeable future.

- Defense and security spending is much higher in absolute terms, though not as a proportion of GDP. Many military budgets depend heavily on security assistance from the U.S. and Europe and on funds received through participating in peacekeeping operations. In some countries the security sector is liable to fracture in ways that bear comparison with the 1980s.

The economic implications of the COVID-19 pandemic for Africa are very uncertain. However, comparison with the recession of the 1980s may be helpful in posing questions.

The four most marked differences are (a) the current crisis hits both the formal and informal sectors extremely hard; (b) a recovery based on a revitalized global oil market is not on the cards; and (c) China is unlikely to pursue a HIPC-like debt forgiveness strategy.

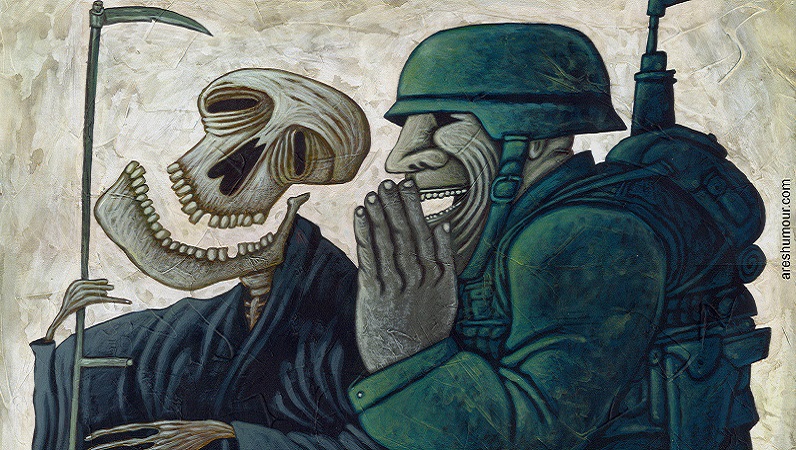

Perhaps the most important constrast is (d) a completely different spirit animating the actions of the major global powers. In the 1990s, the OECD countries had shared principles for jointly managing the global economic commons, and with the demise of the Communist bloc, Africa was no longer an arena of great power rivalry. This paved the way for the progressive global agendas of the late-1990s, with programs such as HIPC, the adoption of the Millennium Development Goals and very substantial international investments in health. Today, the dominance of monetized transactional politics means that, from top to bottom, the trajectory of economic restructuring will be steered by those interests. If the recovery of the 1990s was the occasion for the emergence of the political marketplace, its impacts diluted by a progressive agenda of international cooperation, the economy of the 2020s may be the occasion for the hegemony of rancorous, introverted, zero-sum monetized politics.