Financial Health of Refugees

Understanding Financial Health of Refugees in Jordan and Five Key FINDings from the Finance in Displacement Studies

In this issue of Fresh FINDings, we are excited to share a report written by our partners Swati Mehta Dhawan and Hans-Martin Zademach: Understanding Financial Health of Refugees in Jordan: Empirical FINDings II. We also feature our newest report titled Reckoning with Reality: Five Key FINDings from the Finance in Displacement Studies.

Please visit the Journeys Project at Tufts University for previous studies, ongoing research, videos, maps, and artwork on refugees and migrants in the Middle East and Mediterranean, Latin America, and Africa.

.

This month…

- Understanding Financial Health of Refugees in Jordan: Empirical FINDings II

- Reckoning with Reality: Five Key FINDings from the Finance in Displacement Studies

.

Understanding Financial Health of Refugees in Jordan: Empirical FINDings II

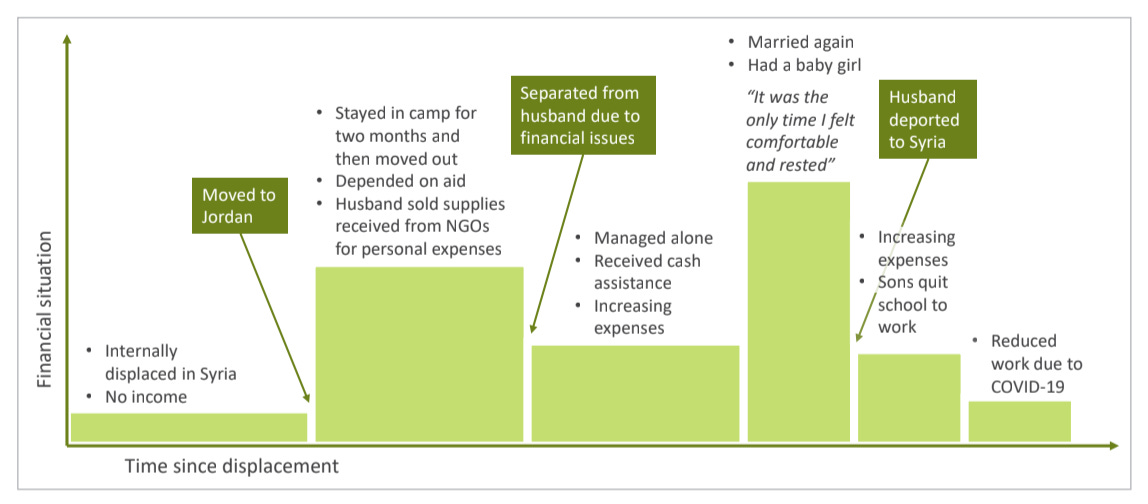

We are pleased to announce the release of the second report of the three-part series Understanding Financial Health of Refugees in Jordan: Empirical FINDings. Written by our partners Swati Mehta Dhawan and Hans-Martin Zademach, this report aims to broaden our understanding of the financial lives of refugees as they remain in protracted displacement in Jordan. The study was comprised of three rounds of in-depth qualitative interviews with 68 participants (a total of 231 interviews) and interviews with 38 key informants from organizations supporting refugees in Jordan. The study focused on refugees in urban and semi-urban centers. Half of our sample were Syrian refugees and, distinct from other studies, the other half included refugees from Iraq, Yemeni, Sudan, and Somalia (“non-Syrian” refugees).

This report builds on the findings presented in an earlier report based on interviews conducted in the first of the three rounds of in-depth interviews. In this piece, we bring together insights from the second and third rounds of interviews. The key aim of this report is to present further empirical findings on the financial lives of research participants in Jordan building upon the theoretical frameworks shared in the previous report and identifying some new ones. Two of the three interview rounds were conducted during the COVID-19 pandemic which led us to observe how refugees’ livelihoods and financial strategies shifted in response to the economic crisis.

.

.

The report closes with a series of recommendations around the objective of improving refugees’ financial health. Two overarching recommendations for international and national actors aim to address broader issues of exclusion, while more detailed recommendations are laid out separately for Syrians and non-Syrians. The researchers structure the policy and programmatic recommendations based on concerned stakeholders including host governments, donors, international humanitarian organizations, NGOs and community-driven organizations, financial regulators and service providers, and researchers.

Click here for a link to the full report

.

Reckoning with Reality: Five Key FINDings from the Finance in Displacement Studies

We are thrilled to announce the launch of the Reckoning with Reality report which examines five key findings that have emerged across the Finance in Displacement Studies. Between 2019-2021, a research collaborative between Catholic University Eichstaett-Ingolstadt, Tufts University, and the International Rescue Committee conducted research in Jordan, Kenya, Mexico, and Uganda on refugees and migrants, focusing on those who had been in their host countries between three and eight years. This brief highlights our main findings and policy recommendations.

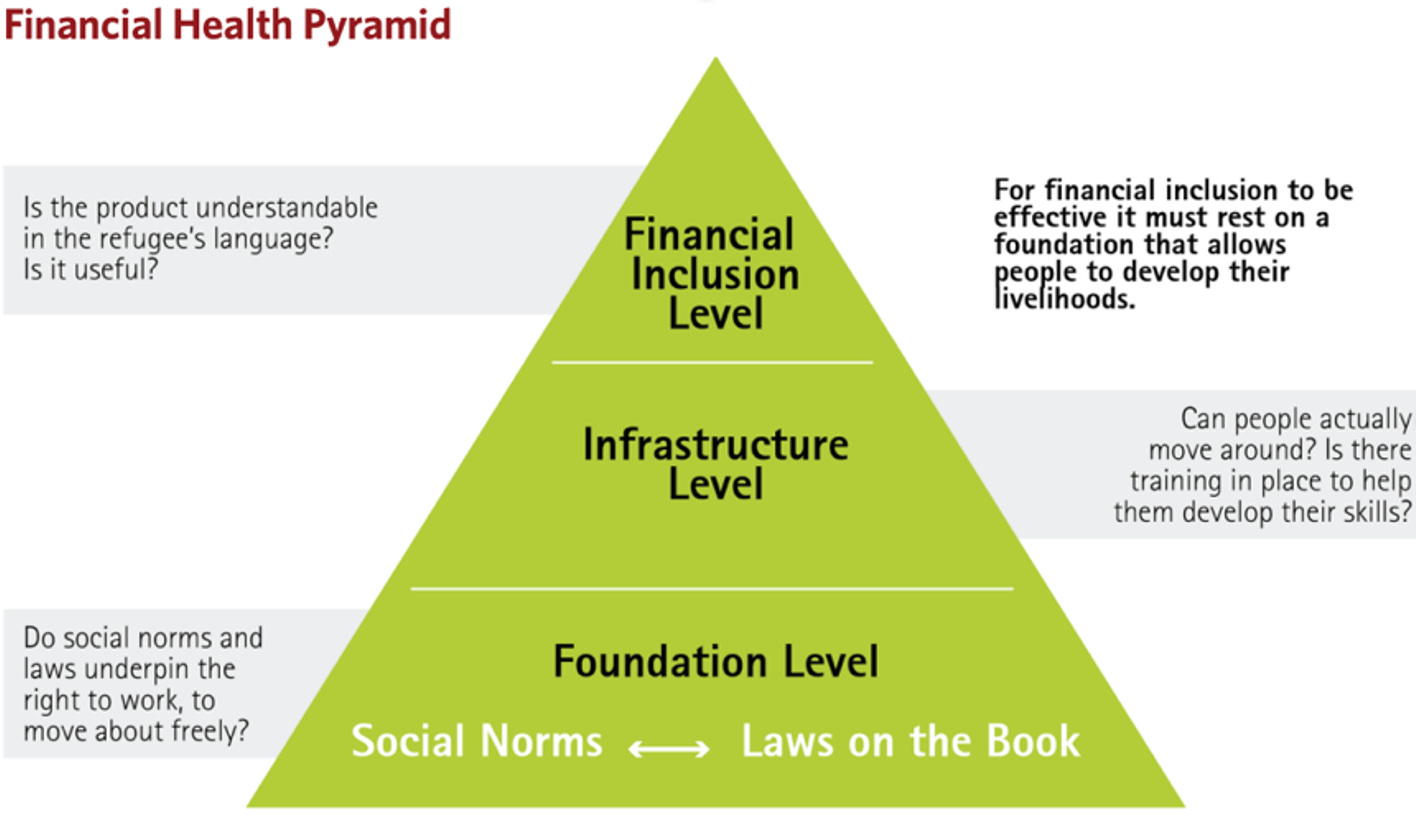

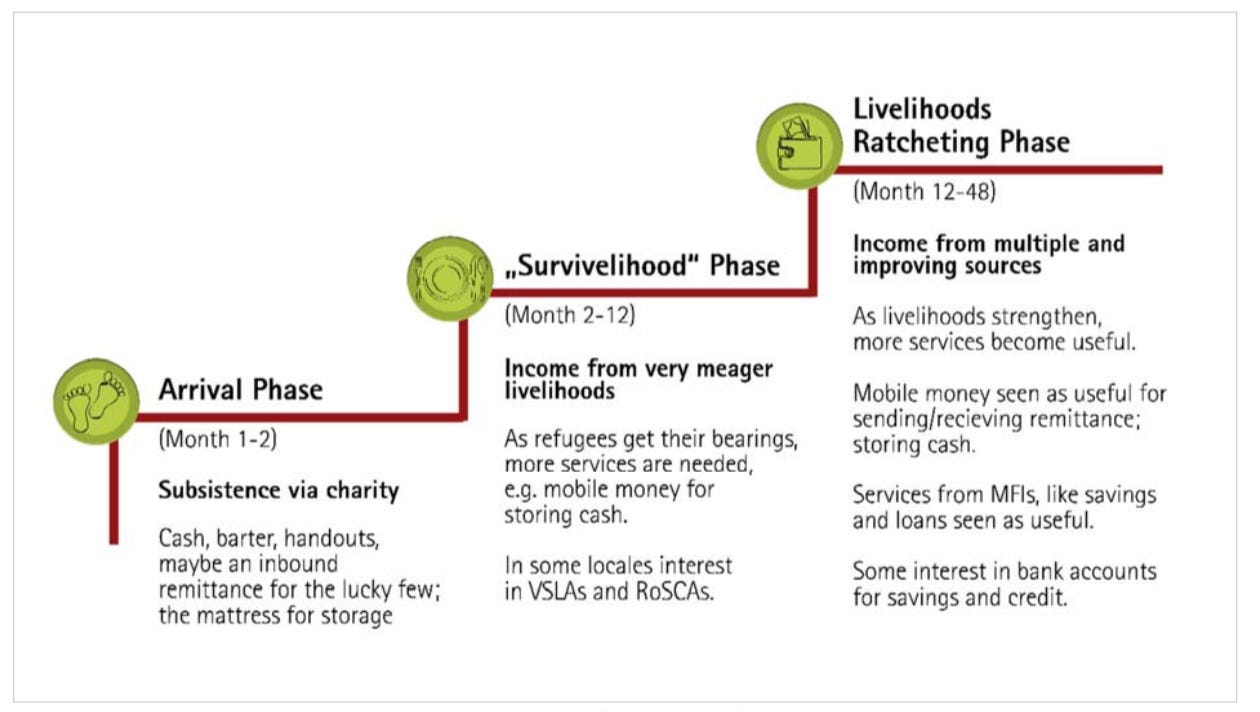

Overall, we found that financial services alone cannot produce significant improvements in financial outcomes. Improved financial outcomes depend on refugees’ ability to navigate pathways to sustainable work and some form of integration, which in turn depend on documentation and the rights to operate a business, work, and move freely in their host country. Still, certain mainstream financial services were valued, and while our respondents could not enjoy regular use of them until their incomes improved, they did not want to be locked out of them. What they rejected was to be experimented upon with fledgling services that were designed “just for them.”

Click here for a link to the full report

.

High-Level Findings:

Finding 1: For financial inclusion policies to make a positive impact, they must build on host government policies that give refugees rights, opportunities, and provide appropriate documentation. The financial success of refugees is contingent on their ability to exercise fundamental economic rights.

.

.

Finding 2: The need for and the uses of financial services coevolve with progressions in the diversification of refugee livelihoods. Current financial services toward refugees are designed to help them survive in a new environment upon arrival. Additionally, diversified services are needed after this initial phase to help refugees build robust, sustainable livelihoods.

Finding 3: Financial service providers (remittance, mobile money, banking, and MFI services) need not create new services for refugees. Instead, they should adapt existing mainstream solutions that are popular with the host population by making necessary adjustments (such as language or documentation needs). Refugees are often forced to use services, channels, or platforms that are not yet mature or have not yet found solid footing within host populations. This impacts the practicality of sustained use of these systems and separates the financial services of refugees in a way that negatively impacts financial inclusion.

Finding 4: The uncertainty of long-term prospects discourages refugee investment in skills and assets, limits self-reliance, and produces a permanent dependence on charity. Instead, they invest energy in hoping for resettlement, a highly unlikely prospect for most. Participants in the study expressed a belief that resettlement was the only way to improve financial circumstances. Lack of access to work permits, SIM cards, residency status, and business assets deter economic investment in this population.

.

.

Finding 5: Our “financial health” framework modified for refugees is useful for analyzing the role of financial services in people’s financial health. We found that financial services are only one contributing factor to financial health. Other indicators include the ability to: 1) meet basic needs 2) comfortably manage debt 3) recover from financial setbacks 4) Invest in opportunities 5) Extend their planning horizons.

.

Fresh FINDings is made possible through a partnership among Tufts University, the Katholische Universität Eichstätt – Ingolstadt (Catholic University or KU), the International Rescue Committee, and GIZ. Fresh FINDings also features work sponsored by Catholic Relief Services, Mercy Corps, and the International Organization for Migration.

Contact: Kimberley.Wilson@tufts.edu

.