Chair Activities

Current and Recent Events

_________________________________________________________________________

2024

Register for the event here.

______________________________________

Register for the event here.

______________________________________

Register for the event here.

______________________________________

Register for the event here.

______________________________________

Register for the event here.

______________________________________

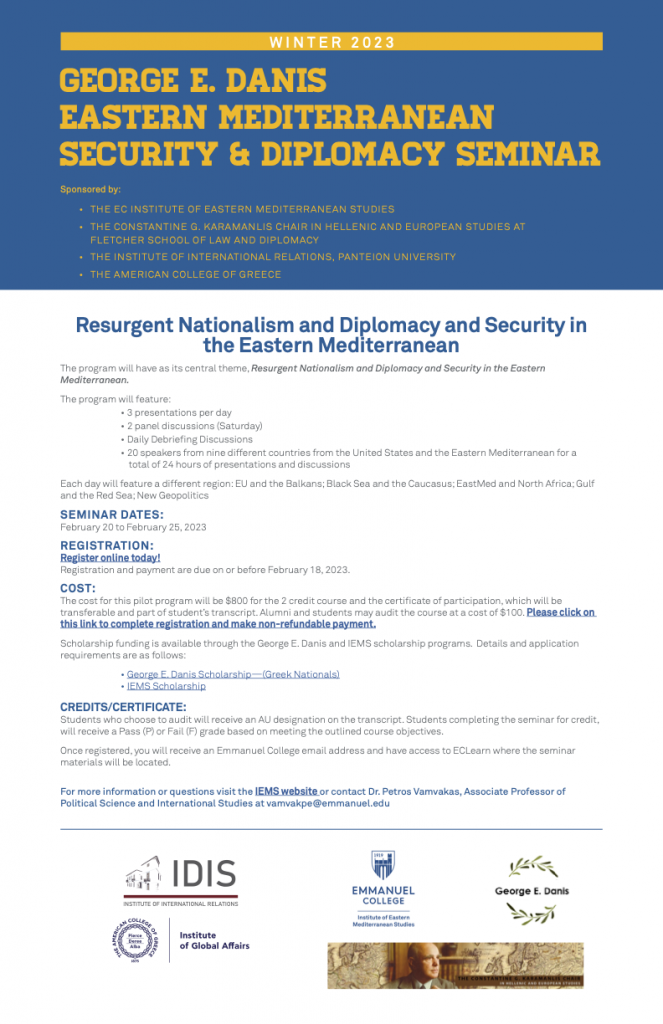

2023

Read more about the event here.

______________________________________

Register for the event here.

______________________________________

View event recording here.

______________________________________

______________________________________

2022

View event recording here.

______________________________________

2021

______________________________________

______________________________________

Watch event recording here.

______________________________________

Event recording available here.

______________________________________

New Perspectives on the Greek Revolution: An International Conference [Online]

Co-Sponsored by the George Seferis Chair of Modern Greek Studies, Harvard University, and the Karamanlis Chair of Hellenic and European Studies, The Fletcher School at Tufts University

Friday, September 24 and Saturday, September 25, 2021

Registration available here.

Conference program:

Friday, 24 September 2021

11:30-11:45 ET (Boston Time)

Introductory Remarks

Constantine Arvanitopoulos (Fletcher School, Tufts University), Panagiotis Roilos (Harvard University), Stratos Efthymiou (Consul General of Greece in Boston).

11:45-13:00

Panel I

Chair: Panagiotis Roilos (Harvard University)

Mark Beissinger (Princeton University)

Greek Revolution in Comparative Perspectives

Alan Henrikson (Fletcher School, Tufts University)

Great Power Intervention and the Independence of Greece: The Theory and Diplomacy of National Liberation

Costas Douzinas (Birkbeck, University of London)

1821 and Philosophy

Patrice Higonnet (Harvard University)

Modern Nationhood and Diplomatic Circumstance

13:00-14:15

Panel II

Chair: Costas Douzinas (Birkbeck, University of London)

Panagiotis Roilos (Harvard University)

Early Philhellenism and the Formation of Modern Hellenism

Christina Koulouri (Panteion University)

Commemorating Revolution: A Transnational Approach to Modern Greek National Memory

Konstantinos Tsoukalas (University of Athens)

Symbolic Aspects of National Anniversaries: Greece, 1821-2021

Konstantina Botsiou (University of The Peloponnese)

Timely Revolutions: Greece and the Great Powers, from 1821 to the Pax Americana

Saturday, September 25, 2021

10:00-11:15

Panel III

Chair: Nikos Alivizatos (University of Athens)

Alexandros Kyrou (Salem State University)

Korais and Jefferson: A Friendship Conceived in Hellenism, a Bond Born in Revolution

Sophia Laiou (Ionian University)

Between an Empire and a Revolution: The Ottoman Greek Bourgeois in 1821

Dimitris Keridis (Panteion University)

Going West, Balancing the Rest: Marketing the Greek Cause Then and Now

Elizabeth Prodromou (Tufts University)

Transnational Religion and Territorialized Church: Reflections on Orthodox Christianity, the Greek Revolution and Geopolitics

11:15-12:30

Panel IV

Chair: Elizabeth Prodromou (Tufts University)

Spyridon Vlachopoulos (University of Athens)

The Constitutions of the Greek Revolution

Nikos Alivizatos (University of Athens)

Alexander Mavrokordatos, Founding Father of Greek Constitutionalism

Constantine Arvanitopoulos (Fletcher School, Tufts University)

The Greek War of Independence in Historical Perspective

Kostas A. Lavdas (Panteion University)

The Unfulfilled Promise: Republican Potential and Power Politics in the 1820s

12:45-14:00

Panel V

Chair: Constantine Arvanitopoulos (Fletcher School, Tufts University)

Kostas P. Kostis (University of Athens)

Thoughts on the Greek War of Independence

Petros Vamvakas (Emmanuel College)

American Philhellenism and the Redemption of a New Nation

George Alogoskoufis (Athens University of Economics and Business)

The Three Historical Cycles of the Greek Economy from 1821 until Today

Evangelos Prontzas (Panteion University)

From the Social Authenticities of the Greek Occupied Territories to the Nationalization of Public Economic Framework

______________________________________

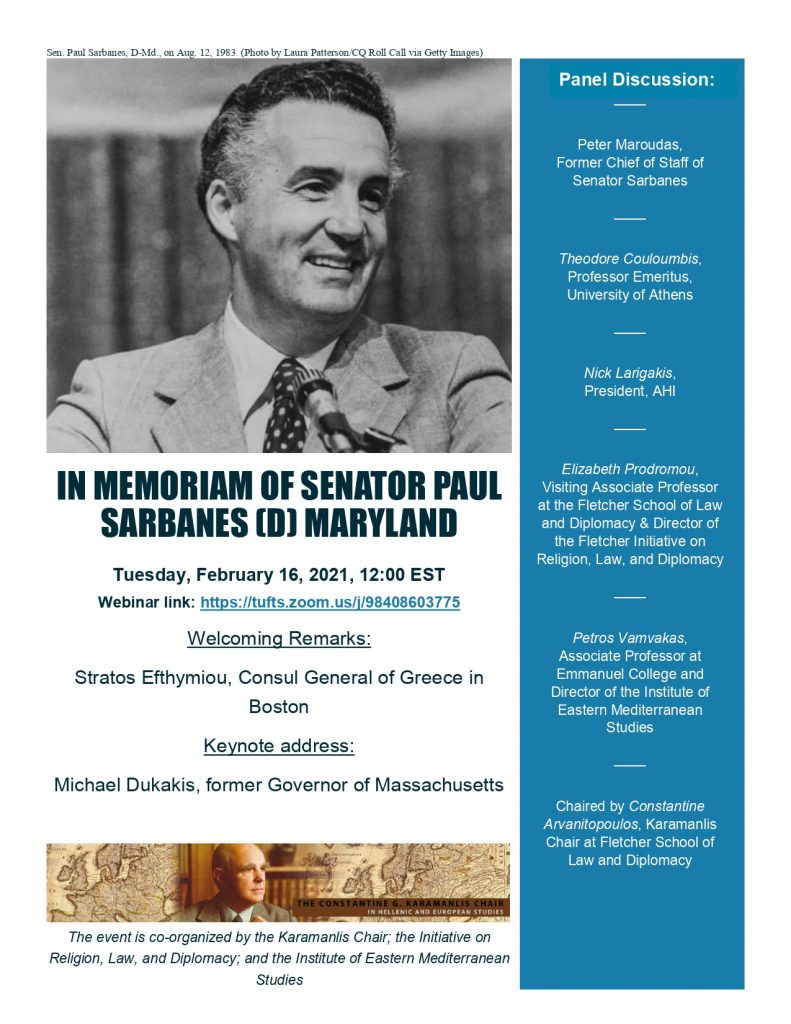

“In Memoriam of Senator Paul Sarbanes [D] Maryland” [Online]

Tuesday, February 16, 2021 at 12:00 PM EST

Event recording found HERE

___________________________________

Winter 2021 Security & Diplomacy Seminar: “A Changing America and A Dynamic Eastern Mediterranean” [Online]

This Seminar offers a large series of events throughout the week. For more details, please see this schedule of events:

Monday, January 11 – Saturday, January 16

________________________________________________________________

2020

_________________________________________

“Transatlantic Relations After the US Election: A Conversation with H.E. Stavros Lambrinidis, Ambassador of the EU to the US” [Online]

Wednesday, December 2nd at 6:00 PM EST (GMT-5)

Remarks and Q&A by H.E. Stavros Lambrinidis, Ambassador of the EU to the US

Hosted by Dean Rachel Kyte and Prof. Constantine Arvanitopoulos

_______________________________________________________________________

“U.S. at a Crossroads” [Online]

Thursday, November 11th at 6:00 PM EET (11:00 AM EST)

David Paleologos, Director, Suffolk University Political Research Center

Ioannis D. Evrigenis, Professor of Political Science, Tufts University

Elisabeth H. Prodromou, Visiting Associate Professor of Conflict Resolution, Tufts University

Konstantinos Arvanitopoulos,Constantine Karamanlis Chair in Hellenic and European Studies at the Fletcher School of Law and Diplomacy, Tufts University

Moderator: Constantinos Filis, Executive Director, Institute of International Relations, Panteion University & Commentator for Ant1

_________________________________________________________________________

“ Implications of the 2020 U.S. Presidential Election for the EU” [Online]

Thursday, November 5th from 10:30 AM – 11:30 AM EST (16:30-17:30 CET)

Video Recording of the Lecture can be found HERE on the Facebook page of the Wilfried Martens Centre for European Studies.

_________________________________________________________________________

“ Greece’s Role in the Eastern Mediterranean” [Online]

Thursday, October 22nd, 2020 @ 5:00 PM EST

Video Recording of the Lecture can be found HERE and the Q & A can be found HERE.

_________________________________________________________________________

2020 Eastern Mediterranean Security Studies Program

“EastMed Security in the Age of Covid-19: 10 Years After the Arab Spring and the Eurozone Crisis” [Online]

1 Week, 10 Lecture/Presentations, Two Panel Discussions, 20 Regional Experts from 10 different countries, Film Series, Discussion

Since travel to the region is prohibited this summer, the EC Institute of Eastern Mediterranean Studies in cooperation with the Constantine G. Karamanlis Chair in Hellenic and European Studies and the Institute of International Relations will be hosting a one-week program of focused lectures, presentations, panel discussions and films.

The one-week program will bring regional experts in two sets of lectures aimed at assessing Democracy, Energy and Geopolitics and on the Role of Leadership, Diplomacy and Statecraft in this changing security environment of the Eastern Mediterranean, 10 years after the “Arab Spring” and the “Eurozone Crisis. ” The presenters will be from the different countries of the region, as well as a mixture of policy makers, diplomats, and academics.

____

Schedule of Presentations and Panels

Monday, June 22nd, 2020

Ms. Polina Anyftou: Iranian Foreign Policy Aspirations in EastMed and MidEast (10:00 EDT/17:00 EEST)

Mr. Thanassis Cambanis: The Arab Uprisings Continue: Unresolved Failures of Governance and Citizenship (14:00 EDT/21:00 EEST)

Tuesday, June 23rd, 2020

Dr. Antonia Colibasanu: Eastern Mediterranean to the Black Sea and Eurasian Stability (10:00 EDT/17:00 EEST)

Dr. Dimitris Tsarouhas: Greek-Turkish Relations Transformed (14:00 EDT/21:00 EEST)

Wednesday, June 24th, 2020

Dr. Aref Alobeid: Democratization in the Arab World (10:00 EDT/17:00 EEST)

Dr. Constantine Adamides: Cyprus in the Sub-Regional Security Complex of the Eastern Mediterranean (14:00 EDT/21:00 EEST)

Thursday, June 25th, 2020

Ambassador Ram Aviram: The East-Med Between the Jordan River and The Nile – The Explosive Hydro-Politics (10:00 EDT/17:00 EEST)

Ms. Sarah Gabreal: Lebanon in the “Perfect Storm” of Economic and Political Crises (14:00 EDT/21:00 EEST)

Friday, June 26th, 2020

Dr. Elizabeth Prodromou: Presentation “Soft Power and Religious Diplomacy in EastMed Geopolitics: Identity, Power, Sovereignty (10:00 EDT/17:00 EEST)

Dr. Berna Turam: Human Security and Migration in Europe’s Southern Borders (14:00 EDT/21:00 EEST)

Saturday, June 27th, 2020

Panel Discussion:

The Role of International Organizations in the Eastern Mediterranean (9:00 EDT/16:00 EEST)

Ms. Ino-Despina Afentouli – Public Diplomacy at NATO

Dr. Dimitris Keridis – Panteion University; ND Member of Hellenic Parliament

Ambassador Vesko Garcevic – Boston University/IEMS

Dr. Nicolas Prevelakis – Harvard University

Panel Discussion: The Eastern Mediterranean 10 Years After the Arab Spring, the Eurozone Crisis at the time of a Pandemic (12:00 EDT/17:00 EEST)

Dr. Constantine Arvanitopoulos – Constantine G. Karamanlis Chair, Fletcher School of Law and Diplomacy

Dr. Constantinos Filis – Director, Institute of International Relations (ΙΔιΣ)

Dr. Sotiris Roussos – University of Peloponnese; CEMMIS (ΚΕΜΜΙΣ)

Dr. Petros Vamvakas – Director, IEMS; Emmanuel College

_________________________________________________________________________

“What Is Next? The Future of Transatlantic Relations after the Pandemic” [Online Event]

Wednesday, June 3rd, 2020 @ 16:30-17:30 (CET) / 10:30-11:30 am (EST)

Karamanlis Chair co-organized this event with the Martens Center for European studies in Brussels

Event topic, details etc.:

Since the end of the Second World War, every US administration has promoted European recovery, transatlantic cooperation, and joint defence. Common interests, together with common principles and values, constituted the bedrock of the post-war partnership between Europe and the US. NATO became an alliance of both interests and values.

Today, however, the transatlantic partnership is facing a new set of challenges. Of these, two are of particular importance: one external, the other internal. The external challenge concerns the rise of two great revisionist powers, Russia and China, as well as Islamic terrorism. The internal challenge is the declining willingness of the US to defend the international order it has created and the fracturing of the core of this system. These global shifts are forcing the Atlantic partnership to re-examine its common interests, its common values, its capabilities, and its strategic objectives.

This event aims to discuss EU-US relations during the Trump administration and how this alliance will evolve after the pandemic. Moreover, how the triangle US-EU-China affects the balance of the international system and how the Western World can defend its values and interests, vis-à-vis emerging political and economic powers.

_________________________________________________________________________

“The EU’s Transformation from Political to Geopolitical”

Dr. Constantine Arvanitopoulos, Fletcher School, Karamanlis Chair of Hellenic and European Studies & Former Greek Minister

Mr. Diego Martinez Belío, Chief of Staff, Spanish Secretary of State for Europe

Dr. Lisbeth Aggestam, Associate Professor of Political Science, University of Gothenburg

Saturday, March 7th, 2020

This three-person panel was part of a series of panels at the “European Conference 2020: The World is Watching” that took place at the Harvard Kennedy School in Cambridge, MA on March 6-7, 2020.

____________________________________________________________________

“Greece After the Eurozone Crisis: Prospects & Challenges“

Stratos Efthymiou, Consul General of Greece in Boston

Wednesday, March 4th, 2020

The Karamanlis Chair in Hellenic & European Studies and the Andreas A. David Scholars of the Fletcher School hosted a lunch discussion with the Consul General of Greece in Boston Stratos Efthymiou, on Wednesday, March 4th, 2:00 – 4:00 p.m., in Crowe Room – Goddard Hall.

_________________________________________________________________________

“The European Union: Confronting Today’s Challenges”

Ms. Olga Kefalogianni

Wednesday, February 19, 2020

The Constantine Karamanlis Chair in Hellenic and European Studies organized a lecture on “The European Union: Confronting Today’s Challenges” on Wednesday, February 19, 2020 with main speaker Ms. Olga Kefalogianni, New Democracy Member of the Hellenic Parliament, former Minister of Tourism. The event was co-organized with the EC Institute of Hellenic and European Studies.

_________________________________________________________________________

“NATO & the Challenges to Multilateralism: Are We Experiencing a Paradigm Shift?”

Ms. Ino-Despina Afentouli

Monday, February 10, 2020 12:30-2:00 pm

The Karamanlis Chair in Hellenic and European Studies at The Fletcher School, Tufts University and the Fletcher Initiative on Religion, Law and Diplomacy was honored to welcome Ms. Ino-Despina Afentouli for a closed conversation about the future of NATO.

Ino-Despina Afentouli is the Program Manager for Partnerships, Cooperative Security and Open Door policies and Program Officer for Greece at NATO’s Public Diplomacy Division (Engagements Team). She is responsible for the elaboration and implementation of the Public Diplomacy Strategy related to NATO’s partnerships, she represents Public Diplomacy Division in the respective NATO Committees and official meetings with the countries under her responsibility and she has the overall management of the communication campaigns in cooperation with state authorities and/or NGOs. Ms. Afentouli joined the organization in 2001. From 1986 to 2001, she worked as a journalist and columnist specialising in Foreign Policy and European Affairs. She was European Affairs Editor at the Athens News Agency (1997-2001), editor-in-chief of the Greek edition of the Economist Intelligence Unit reports ( 1996-1999), diplomatic correspondent, STAR Channel (1995-1996) and Messimvrini Daily, (1995-1996), political correspondent, Kathimerini Daily (1989-1994), Foreign Affairs editor, Athens Municipal Radio (1986-1989).

She studied Law at the Athens University (BA) and earned a MA in Political Communication at the University of Paris-I (Sorbonne). She also attended the Institut Francais de Presse (University of Paris II). She was a member of the European Association of Journalists and received the Kalligas Award (November 2000) for contributing to the dissemination of European ideas in Greece. She was also Secretary General of the European Network of Women Journalists (1994-98) and official candidate of Greece for the prize Women of Europe in 1993. In addition, she was a member of the Greek-Turkish Forum aiming at the promotion of civil society cooperation between Greece and Turkey (1996-2000) and member of Win Peace, a women’s organisation promoting cooperation in South Eastern Europe.

________________________________________________________________________

2019

______________________________________________________

“Greece and the Euro: From Crisis to Recovery”

The Fletcher School of Law and Diplomacy

Cabot Building, 160 Packard Avenue, Medford 02155 MA

Friday, April 12, 2019 9:00am-6:30pm

The Karamanlis Chair in Hellenic and European Studies at the Fletcher School, Tufts University and the Hellenic Observatory, London School of Economics organized the conference.

The conference was organized by Prof. George Alogoskoufis, Karamanlis Chair, Fletcher School, and Prof. Kevin Featherstone, Venizelos Chair, London School of Economics. The conference has been organized with financial support from the Onassis Foundation.

The purpose of the conference was to assess the causes of the Greek crisis and the prospects for the Greek economy after the conclusion of the economic adjustment programs in 2018. The morning plenary sessions and the afternoon two parallel sessions concentrated on the economics and politics of reform in Greece.

The conference was opened by Prof. Ian Johnstone, Dean of the Fletcher School. The keynote address was by Prof. Lucas Papademos, Member of the Academy of Athens and former Prime Minister of Greece, who was introduced by Prof. Steven Block, Academic Dean of the Fletcher School.

Two panels of speakers provided overviews of the economic, institutional, political and cultural aspects of Greece and the Euro, both before and after the crisis.

These included, in alphabetical order, George Alogoskoufis (former Minister of Economy and Finance of Greece), George Chouliarakis (Alternate Minister of Finance of Greece), Nikos Christodoulakis (former Minister of Economy and Finance of Greece), Kevin Featherstone (Head of the Hellenic Observatory at the LSE), Stathis Kalyvas (Gladstone Professor of Government, Oxford University) and Panagiotis Roilos (Seferis Professor of Modern Greek Studies and of Comparative Literature, Harvard University). The two panels were chaired by Prof. Yannis Ioannides (Max and Herta Neubauer Chair and Professor of Economics, Tufts University) and Prof. Constantine Arvanitopoulos (Professor of International Politics, Panteion University).

The afternoon sessions, in which papers were presented by a number of leading economists, political scientists and other experts, concentrated on more specialized aspects of reform of both Greece and the euro area. The sessions were as follows:

The Euro Area After the Crisis

Chair: George Chouliarakis (Ministry of Finance)

Yannis Ioannides (Tufts), Reforms, Deficits and Debt: a Unifying Framework for a Fiscal and Monetary Union

Athanasios Orphanides (MIT), Overcoming the Euro Crisis.

George Alogoskoufis (Fletcher and AUEB) and Laurent Jacque(Fletcher), Economic and Financial Asymmetries in the Euro Area

George Pagoulatos (AUEB and ELIAMEP), The Euro Area after the Crisis: An Economic and Political Stocktaking

Fiscal, Financial and Labor Market Reforms

Chair: Ploutarchos Sakellaris (AUEB)

Apostolis Philippopoulos (AUEB) and George Economides (AUEB), Fiscal and Institutional Preconditions for a Sustained Recovery

Eleni Louri (AUEB) and Petros Migiakis (Bank of Greece), Financial Preconditions for a Sustained Recovery

Vassilis Monastiriotis (LSE), The Labor Market and Greece’s Unemployment Problem

Productivity, Income Redistribution and Growth

Chair: Nikos Christodoulakis (AUEB)

Nikolaos Leounakis and Ploutarchos Sakellaris (AUEB), Greek Economic Growth: Past and Future

Eirini Andriopoulou, Eleni Kanavitsa and Panos Tsakloglou (AUEB), Income Re-Distribution: From Crisis to Recovery

Institutional Reforms for a Sustained Recovery

Chair: Angelos-Stylianos Chryssogelos (Harvard)

Stella Ladi (Panteion, QMC) and Manto Lampropoulou, Market Regulation via Independent Agencies in Post-Crisis Greece

Calliope Spanou (UOA), Competing Frames and Domestic Discretion: Public administration reform in Greece

Georgia Kaplanoglou (UOA), Fiscal Institutions and the Monitoring Public Finances: The case of Greece

Political Reforms for a Sustained Recovery

Chair: Stathis Kalyvas (Oxford)

Spyros Kosmides (Oxford), Public attitudes towards domestic reform: Continuity and Change

Dimitri A. Sotiropoulos (UOA, Fletcher, Harvard), State-society relations and Domestic Reform Coalitions in Greece in Comparative Perspective

Kevin Featherstone (LSE) and Dimitris Papadimitriou (Manchester), External Discipline and the Greek bailouts: Process makes Politics

Greece’s Foreign Relations after the Crisis

Chair: Stratos Efthymiou (Ministry of Foreign Affairs)

Katerina Sokou (GWU and Kathimerini), Fast Forward: The Return of Geopolitics in US-Greece Relations

Spyros Economides (LSE), Greece’s Foreign Relations after the Crisis

Webpage of the Greece and the Euro Tufts LSE Conference

____________________________________________________________________________

“Kyriakos Mitsotakis, Leader of the Opposition in Greece, at the Fletcher School”

March, 7, 2019

The leader of the opposition in Greece, and President of New Democracy (ND), Kyriakos Mitsotakis, spoke at the Fletcher School, Tufts University in Boston on March 7, 2019.

He gave the annual Behrakis Family Lecture. The Behrakis Family Endowed Lecture Series, within the Constantine G. Karamanlis Chair in Hellenic and European Studies, is presented annually to promote the understanding of Greece’s domestic and international affairs.

He was introduced by Professor Ian Johnstone, Dean ad interim of The Fletcher School, while Professor George Alogoskoufis moderated the conversation.

Athens News Agency

March 7, 2019

Describing the economy as the issue that will determine the outcome of the forthcoming elections, main opposition New Democracy (ND) leader Kyriakos Mitsotakis on Thursday estimated that 2019 will be a decisive year for the country’s path to recovery.

During his speech at Tufts University, the leader of the main opposition party argued that the country needs a “political change” to achieve stronger growth that would be sufficient to actually improve the daily lives of Greek citizens.

Mitsotakis said that he hopes that 2019 will be a year of significant and substantial political change. “I am not saying this because it is my obligation to do so as opposition leader but because I fundamentally believe that political change is now a prerequisite for Greece to face the future with sustainable optimism,” he added.

Mitsotakis estimated that for the first time markets view the possibility of elections as a positive development that will help consolidate stability.

Moreover, he analysed the main pillars of his economic programme, which, he said, focuses on investment and aims at growth.

“I am very worried about inequality,” he said and added: When I proposed the development plan for the next day, I was always talking about growth without exclusions. Therefore, growth in Greece today must be driven by investment. It can no longer be driven by consumption, as was the case in the past. And in order to promote growth through investment, some basic conditions must be created.

Regarding how Greece will become an attractive investment destination, Mitsotakis noted that he will “aggressively” move to improve the business environment through the methodical implementation of targeted reforms that will correct the systemic causes of corruption and bureaucracy.

Link to the Fletcher Invitation to the Lecture

Link to Athens News Agency Report

______________________________________________________________________________

A Seminar with President Hollande

Harvard Kennedy School

March 10, 2019

Professor George Alogoskoufis chaired a seminar with François Hollande, President of the French Republic 2012-2017, on the European Union and the transatlantic relation, at the Harvard Kennedy School of Government, on Sunday, March 10, 2019.

The seminar was organised in the context of the annual Europe Conference of students from Harvard and the Fletcher School, Tufts University, and was attended by both faculty and students from the two institutions.

President Hollande made an opening speech, and there was an extensive Q&A session coordinated by Professor Alogoskoufis. The discussion revolved around issues such as migration, enlargement, the economy, trade, and the governance of the European Union and the Euro Area.

______________________________________________________________________________

2018

____________________________________________________

“The Euro Area at Twenty: A Reality Check”

Harvard Kennedy School

December 4, 2018

Summary of talk by George Alogoskoufis, Karamanlis Chair at the Fletcher School, Tufts University, at the Weatherhead Center, Harvard University, Tuesday, December 4, 2018.

All periods of monetary cooperation in the European Union were characterized by significant macroeconomic and financial asymmetries among member states in the core and the periphery, but also by different degrees of monetary integration.

With the deepening of monetary cooperation, in the evolution from the snake to the euro, some of these asymmetries were addressed, while others were not.

The main asymmetries addressed by the EMS and the Euro were nominal asymmetries, such as asymmetries in inflation rates.

When the euro was created, very little was done to address the remaining real and financial asymmetries, effectively shifting the burden of adjustment to individual euro area members and their fiscal systems.

In the first ten years since the creation of the euro, real asymmetries resulted in the build up of significant external imbalances between the core and the periphery of the euro area, and, eventually contributed to the eruption of the euro area crisis.

The main financial asymmetric shock appears to have been the creation of the euro itself, which initially brought about the convergence of nominal and real interest rates between the periphery and the core. Nominal and real interest rates in the periphery converged very quickly to the lower levels that existed in the core, as the premium due to exchange rate risk disappeared. In fact, as inflation rates converged much more slowly than nominal interest rates, real interest rates in the periphery fell even more. This convergence resulted in a widening of savings and investment imbalances in the periphery, which up until then had relatively high nominal and real interest rates.

The convergence of interest rates brought about the widening of external imbalances, the buildup of external debt by the countries of the periphery, and created the pre-conditions for the euro area financial crisis.

This process was exacerbated by the “home” bias of banks in the countries of the euro area, due to the fact that the euro area was not a banking union.

The euro area crisis was essentially an “external” debt crisis in an economic and monetary union with a single currency, but major economic and financial asymmetries and significant governance problem areas.

As a result, the euro area crisis of the 2010s was, at the end of the day, no different than other regional financial crises involving indebted economies, such as the Latin American crisis of the 1980s and the Asian crisis of the 1990s.

The ‘sudden stop’ led to a significant crisis rather than a more manageable problem since EA members could not devalue and the ECB could not bail out the governments of the periphery.

A confidence crisis followed, first about the countries of the periphery, but later about some of the core countries, regarding their ability to service their public and private external debts. This was exacerbated by the delayed and unsuccessful initial efforts to address the problem.

The proximate causes of the crisis – imbalances and lack of effective crisis management mechanisms –tell us that there are really three sorts of underlying causes:

- Design and policy failures that allowed the imbalances to develop and get so large

- Lack of institutions to absorb shocks at the EA level.

- Crisis mismanagement

Some of these failures involved unanticipated events. Others were systemic and others were due to a failure to implement the provisions of the treaties.

The major systemic problem areas included,

- Major differences in the product mix between the core and the periphery

- Fragmented national labor markets and low cross border labor mobility

- Widely different fiscal systems

- Imperfect financial integration and lack of effective cross border financial regulation

- An extremely low federal budget that would act as an automatic stabilizer through transfers from booming economies to economies suffering from recession

- Lack of a lender of last resort to banks and sovereign governments it times of crisis.

A result of the major asymmetries and other economic and governance problems of the euro area is the fact that adjustment efforts since the crisis have shifted the burden exclusively towards the weaker economies in the periphery of the euro area, which suffered deep recessions, a significant rise in unemployment, continuous tax rises, exorbitant social costs for young workers and old age pensioners, and rises in government debt to GDP ratios.

The euro area is in urgent need for additional fiscal, financial and labor market reforms.

The most important one is a significant EA budget, through a moderate and appropriately targeted increase in the EU budget. This would help smooth out the asymmetric impact of macroeconomic shocks through the operation of automatic fiscal stabilizers. It would also help EA countries in recession face fewer fiscal and financial consequences of such recessions, and would also partly address labor market fragmentation.

A significant part of the fragmentation of labor markets in Europe is the result of the lack of a cross border system of unemployment and health insurance. This could be addressed in a reform that would allow for a moderate increase in the EU budget targeted to euro area wide unemployment and health insurance.

The objections of net contributors to a moderate increase in the EU budget could in principle be overcome by an appropriate rules based fiscal reform that would address moral hazard and other coordination problems that are usually evoked as counter-arguments.

The EU and the EA are already transfer unions, through the operation of the single market and the monetary union. They encourage significant economic transfers from weaker and less competitive sectors and economies in the periphery, to stronger and more competitive ones, as suggested by the macroeconomic performance of the core and the periphery following the creation of the Euro area.

A fiscal transfer union, which would result from an increase in the EU budget, would partly correct the effects of such transfers through fiscal redistribution, and is a logical counterpart of the single market and the monetary union.

At the same time the banking union should proceed as planned, national reform efforts should be strengthened, especially in the periphery, and the stability and growth pact should be strictly enforced.

Link to Slides of Full Presentation

Link to Video of Mario Draghi’s “Whatever it takes” Statement

______________________________________________________________________________

2016

____________________________________________________

“Greece and Europe: A Troubled Economic Partnership”

Alogoskoufis in the Huffington Post

October 13, 2016

It is rumored that Constantine Karamanlis, the Greek statesman who was the architect of Greece’s participation in the European Union, once remarked, “I am throwing the Greeks into the sea, and they will have to learn to swim.”

Thirty-five years down the road, it is still uncertain whether the Greeks, able sea navigators throughout their history, can prove to be good swimmers in the European seas.

The crisis of 2010 in addition to earlier mini crises and near misses of the late 1980s and early 1990s are indicative of the roughness of the seas that the Greeks have had to navigate and their well-documented resolve to do things “their way.”

…

What is to be done now? The first priority is to acknowledge the limitations and the weaknesses of the current Greek adjustment program. The second is for the troika (EC Commission, ECB, IMF) and the Greek authorities to cooperate on the design of a new mutually acceptable adjustment program to be adopted by a wider political spectrum in Greece than just the current government. The revised adjustment program must enjoy wide political legitimacy in Greece itself, which is something that does not apply to the current program. The third priority is the consistent application of the program in a way that inspires confidence that the program is there for the medium term.

2012:

10/11/12

Thomas Mayr-Harting, Ambassador of the European Union in the United Nations, “The EU in the UN: One voice or many voices?”

9/26/12

Olli Rehn, Vice President of the European Commission responsible for Economic and Monetary Affairs and the Euro, “The way forward for European Integration”

2011

10/12/11

Pierre Vilmont, Executive Secretary General of the European External Action Service, “Europe and the Challenges of today s global world”

2010:

10/26/10 Joao Vale de Almeida, Head of the European Union Delegation to the United States, “In search for European Foreign and security diplomacy”

9/27/10 Baroness Catherine Ashton, High Representative for Foreign Affairs and Security Policy of the European Union, “Europe s global role after Lisbon”

2009:

9/18/09 Javier Solana, European Union High representative for the Common Foreign and Security policy, “Europe s role in confronting global security challenges”

2008:

10/29/08 Alain Lamassoure, Member of the European Parliament, Member of the EPP Bureau, “Transatlantic Relations after the US elections: What does Europe expect”

10/8/08 Stavros Dimas, Commissioner of the European Union: Environment, “Environmental policy making in the European Union”

2007:

10/18/07 Jacek Saryusz-Wolski, Chairman of the Commission of Foreign Relations: European Parliament, “Enlargement of the European Union: past and future”

12/7/07 Andris Piebalgs, Commissioner of the European Union: Energy, “The European energy policy: challenges and responses”

2006:

12/4/06 Jamie Shea,Director-General for External and Politico-Military Affairs, Council of the European Union, “Global NATO: overdue or overstretch?

11/1/06 Robert Cooper, Director General for External and Politico-Military Affairs, Council of the European Union, “Europe as a foreign policy actor. What it isn’t .What it is. How it (really) functions. Why it is good for the USA”

10/10/06 Hans-Gert Poettering, MEP, Chairman of the EPP-ED Group in the European Parliament, “EU and US- Common responsibility in the world”