Federal Tax Return – how to request a copy of your 1040 or W-2 form

Although the IRS Data Retrieval Tool (DRT) may be used to import certain federal tax information to the Free Application for Federal Student Aid (FAFSA), the Cummings School Financial Aid Office requires those who are applying for institutional financial aid to submit a signed copy of the required 1040 tax forms and W-2 forms filed by the student and his/her parents in addition to entering tax information on the FAFSA. There is additional information the aid office requires that is not included on the FAFSA.

If you do not have a copy of the required tax return and/or W-2 Form(s) to submit with your aid application, the IRS offers guidance on its web site: https://www.irs.gov/individuals/get-transcript.

- If you prepared/filed your return using a tax software product, access the software product to print a copy of your return if it was saved.

- If you filed your return using a tax professional, contact the preparer to request a copy of your return and supporting documents.

- Use the IRS Get Transcript Online to download your tax transcript. Per the IRS, review the identity authentication requirements for Secure Access before attempting to register to use the option.

- Use Get Transcript by Mail and a transcript will be mailed to the address on your return within five to 10 days. If using Form 4506-T to request a transcript to obtain W-2 Forms, be sure to check the appropriate box on the form to include W-2 information.

- You may also call the IRS automated line at 800-908-9946 to order a transcript by mail.

Tax Return Signature Requirement

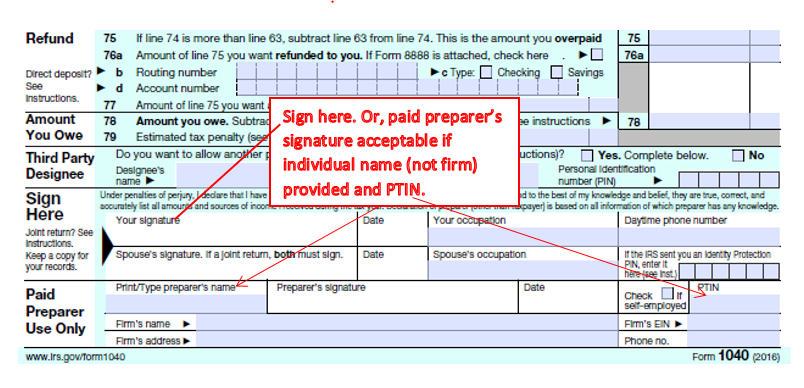

When submitting tax returns to the Financial Aid Office, please note the following: The IRS e-file Signature Authorization – Form 8879, is NOT an acceptable substitute for a signature on the tax return. The IRS e-file Signature Authorization applies to the IRS e-file process, but is not acceptable by the Department of Education for financial aid purposes.

Please sign your 1040 on the appropriate signature line, which is on page 1 of the 1040-EZ and on page 2 of the 1040-A and 1040 (example below).

1040: Sign on page 2

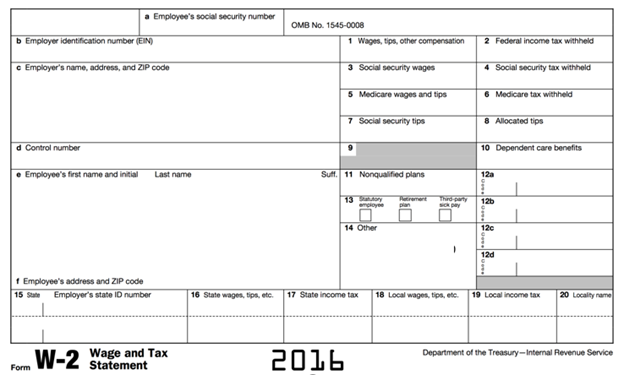

W-2 Wage and Tax Statement: If you earned from work, the following form must be included with the copy of your federal tax return that you submit to the Financial Aid Office. You should have a W-2 from each employer you worked for in the calendar year.