There are many resources available to help meet educational expenses, including grants and scholarships as well as loans and employment programs. Grants and scholarships are considered the most favorable form of financial aid because they do not generally require repayment. There may be other criteria associated with grant and scholarship eligibility, such as financial need and satisfactory academic progress. Application requirements and deadlines are set by the organization providing the assistance. In addition to school-based financial aid, applicants may by eligible for federal and state financial aid as well as aid scholarships offered by regional associations, local organizations, clubs and businesses.

The information provided within these pages is supplemental to information provided directly by the Cummings Veterinary School Financial Aid Office and through the official school website (http://vet.tufts.edu/admissions/financial-aid/).

How and when do students apply for financial aid?

Application materials and deadlines are published annually on the school’s website. Prospective students will receive application information from the Admissions Office. Continuing students will receive annual application information by email from the Financial Aid Office.

DVM Program

Cummings School DVM students may apply for institutional financial aid and federal student aid.

Institutional aid is awarded on the basis of calculated financial need. Using an institutional need analysis, the Financial Aid Office will determine a student’s need and develop a financial aid package that may include a combination of institutional funds and federal student loans. Students who do not qualify for institutional aid will receive an aid package made up of federal loans, if eligible.

Graduate Programs

Animals & Public Policy ♦ Conservation Medicine

Students enrolled in Cummings School graduate programs may apply for federal student aid. Institutional financial aid is not available for MS-Graduate programs.

DVM Students

| To apply for both institutional & federal aid | To apply for federal aid only |

| *CSS Profile Application *Free Application for Federal Student Aid *A copy of student’s federal tax return *A copy of parents’ federal tax return *Items required to apply for institutional aid. | Free Application for Federal Student Aid |

Graduate Students

Free Application for Federal Student Aid

MAPP & MCM Deadline: Rolling/ongoing

| Tuition Payment Plan As an alternative to borrowing or making a lump sum tuition payment before each term, you may consider budgeting all or a portion of your tuition charges into monthly payments. Tufts offers a payment plan option through Cashnet. The earlier you enroll in a payment plan prior to the start of the academic year, the lower each monthly payment will be. For more information, visit https://commerce.cashnet.com/cashneti/paymentportal/login.aspx. For additional general billing and payment information, please visit http://finance.tufts.edu/controller/bursar/generalinfo/. |

SOURCES & TYPES OF FINANCIAL AID

Federal Student Aid

Student loans: Federal Direct Student Loans, Health Professions Student Loan (HPSL for DVM program only)

Based on the results of the Free Application for Federal Student Aid (FAFSA), the school determines eligibility for federal aid.

| Cummings School Institutional Aid – DVM Program Need-based grants Need-based loans Each school follows its own need analysis to determine eligibility for institutional aid. | How is need for need-based aid determined? FINANCIAL AID EQUATION Cost of Education/Attendance (Tuition, fees, living expenses) – Expected Family Contribution* = Need * Calculated by school for institutional aid using a standardized need analysis. |

Outside Awards

Outside awards are scholarships awarded by private or public organizations, local community groups (kennel clubs, state veterinary associations, prior school, etc.)

Typically, any outside award a student receives for/during the academic year will be counted against loan eligibility. All students are encouraged to seek outside aid.

Resources & Useful Websites

Applicants

should explore financial aid from all sources. The following resources

provide information about scholarships, financial planning and/or loan

repayment calculators. There are many resources available to assist you

during all phases of the application, enrollment and

graduation/repayment process.

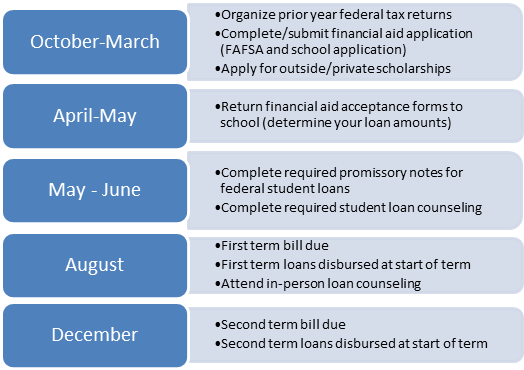

- Forms: Free Application For Federal Student Aid (FAFSA) https://studentaid.gov (also review school’s required forms)

- State Aid: not common at graduate level (explore your state’s higher education resources)

- The Financial Aid Information Page: https://finaid.org/ (financial aid guidance including loan repayment calculators and scholarship search)

- The College Board: https://www.collegeboard.org/ (scholarship search)

- U.S. Department of Education Student Guide https://studentaid.gov/ (federal student aid guide)

- Federal Student Aid Tools & Resources/Financial Awareness Counseling https://studentaid.gov/app/counselingInstructions.action?counselingType=fa

- Association of American Veterinary Medical Colleges https://www.aavmc.org/becoming-a-veterinarian/funding-your-degree/

- Armed Forces Health Professions Scholarship Program (merit program may pay up to 3 years of school costs and living expenses) http://www.goarmy.com/amedd/hpsp.jsp

- International Student Resources http://www.edupass.org/ http://www.internationalstudentloan.com/

- USDA Veterinary Loan Repayment Program http://www.nifa.usda.gov/nea/animals/in_focus/an_health_if_vmlrp.html

- Income Based Repayment and Public Service Loan Forgiveness for Federal Loans http://ibrinfo.org (additional information on www.studentaid.ed.gov web site)

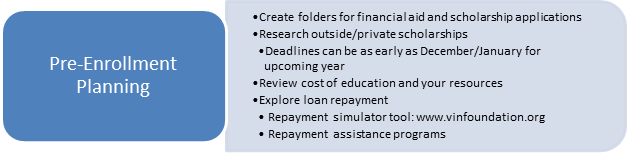

- Loan repayment simulator tool: www.vinfoundation.org

- Tufts Loan Repayment Assistance Program: https://students.tufts.edu/financial-services/student-loan-repayment/loan-repayment-assistance-program-lrap

- To be eligible to apply for Loan Repayment Assistance Program, applicant must:

- Have a Tufts undergraduate, graduate, or professional degree. Certificates do not qualify for LRAP.

- Have incurred student loans for the purpose of attending a Tufts University school. Loan is required to have been been certified by the Tufts Financial Aid Office.

- Be employed full time by a public sector or nonprofit (501(c)3 or equivalent) organization.

- Please visit the Tufts LRAP website for additional eligibility requirements.

- To be eligible to apply for Loan Repayment Assistance Program, applicant must:

- A positive credit record is important to you now and in the future!

- Review your credit history & current credit status: www.annualcreditreport.com

- Report errors to credit bureau.

- Use credit wisely

- Manage your spending before, during & after enrollment www.mymoney.gov

- Eliminate consumer debt prior to enrollment (credit cards, car payments)

- Borrow as little as possible

- Review and understand repayment plan options before borrowing