Capital Ideas: Research Affiliate Vitaly Veksler on the Future of International Stock Leadership

Vitaly Veksler, SovereigNET Research Affiliate and CEO & Portfolio Manager at Beyond Borders Investment Strategies (BBIS), has recently published a report titled “Potential Change of Leadership from US and Growth Stocks to International and Value Stocks in 2021-2023.” The report describes projected catalysts that may ultimately lead to a reversal in stock performance trends.

The report explains why growth and US-based stocks have outperformed value and international-based stocks over the last fourteen and eleven years, respectively; however, we can expect to see a reversal of this trend throughout the next few years.

One of the key drivers of this shift, BBIS explains, is the end of the Federal Reserve’s quantitative easing (QE) policy, during which the Fed poured a massive amount of liquidity into capital markets. Since post-pandemic economic growth is on the rise, Federal Reserve Chair Jerome Powell stated that the Fed may start raising interest rates in 2023.

QE has been a major driver of the US stock market, particularly growth stocks; there is a high correlation (.69) between the growth rates of the Federal Reserve’s balance sheet and the S&P 500’s market capitalization lagged by eight months. And the ending of this policy, along with interest rate increases and increased demand for commodities (due to the eventual rebuilding of supply chains and the recent passing of the $1.2 trillion Infrastructure Investment & Jobs Act), could be beneficial for the growth of value and value-heavy international stock indices.

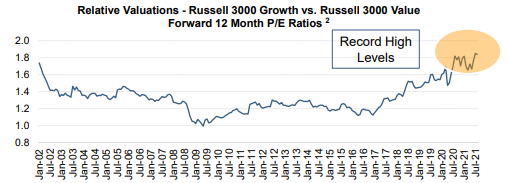

In addition, valuations for growth stocks (particularly the FAANG stocks) are high and could potentially lead to less demand for these assets.

Additionally, there are catalysts for international stocks to eventually start outperforming US stocks. For one, US assets are generally seen as more attractive during economic crises since US assets are considered “safe havens.” As capital flows out of the US with global recovery, there will likely be more demand for foreign goods and commodities. International equities also tend to outperform US equities during periods of economic expansion.

In sum, the rising attractiveness of international assets in the (mostly) post-pandemic world is in part due to rising US consumption, higher US trade deficit, higher government budget deficit, higher government debt, higher taxes, higher inflation caused by both domestic and international forces and that may last longer than the Federal Reserve expects, and higher and more intrusive regulations. All of these factors can be negative catalysts for the US Dollar and US stock markets in 2021-2023.

Click here to read the full report.