The FIND Symposium: Findings, Expert Discussion, and Recommendations for Refugee Financial Services

Building a strong foundation for effective refugee financial services

At the end of April, we were thrilled to host the two-day Find Symposium where we explored the financial integration of refugees drawing on recent research conducted in Jordan, Kenya, Mexico, and Uganda.

The findings disseminated throughout the Symposium promise exciting new program possibilities for the role of financial services in enhancing refugee financial strategies. Here is a breakdown of our two-day FINDings.

You can find all of the Find Symposium resources, reports, and more at the Journey Project website.

Day 1: FINDings, Practicalities, and Policy Implications

Overall, we found that financial services alone cannot produce significant improvements in financial outcomes. Improved financial outcomes depend on refugees’ ability to navigate pathways to sustainable work and some form of integration, which in turn depend on documentation and the rights to operate a business, work, and move freely in their host country.

Still, certain mainstream financial services were valued, and while our respondents could not enjoy regular use of them until their incomes improved, they did not want to be locked out of them. What they rejected was to be experimented upon with fledgling services that were designed “just for them.”

Here are the five key findings from our research. You can find a more detailed report of the findings as well as country-specific recommendations for Kenya, Jordan, Uganda, and Mexico in our High-Level Findings summary.

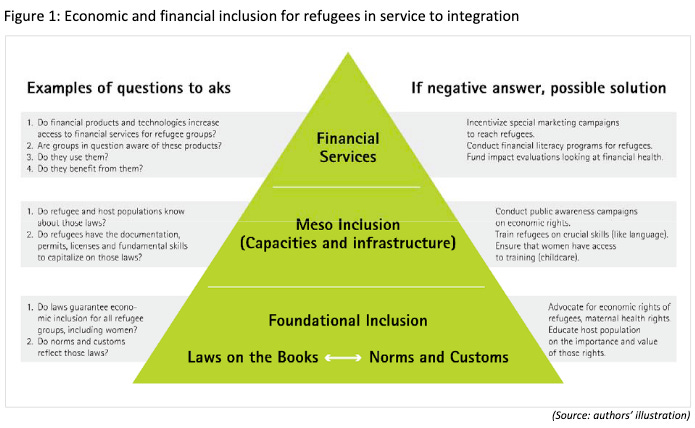

Finding #1: For financial inclusion policies to make a positive impact, they must build on host government policies that give refugees rights, opportunities, and provide appropriate documentation.

The consequences of a lack of legally recognized and easily obtainable IDs, permits, and licenses are serious for both refugees and their host country—refugees are driven into the underground economy.

- Refugees need documentation, such as asylum ID cards and work permits, to access livelihood and income opportunities. Without the ability to earn an income, refugees have limited uses for financial services.

- Laws that guarantee economic inclusion, norms and customs that reflect those laws, and awareness and access to the documentation needed for refugees to benefit from those laws and norms are foundational underpinnings to effective financial services.

Recommendations

To address the challenges of weak foundational policies and harmful social norms, host governments should be encouraged and supported by donors and the private sector to:

- Reduce work barriers and restrictions, including limitations on freedom of movement. In consultation with refugees, civil society members, employers, policymakers, and regulators, a review and revision of national laws and policies to allow for increased economic opportunities should occur.

- Provide current, easy-to-procure documentation, particularly documents related to identity and the various permits required to secure shelter and a decent livelihood.

- Challenge current norms held by government service providers, employers, and financial service suppliers that stigmatize refugees and block them from using mainstream services.

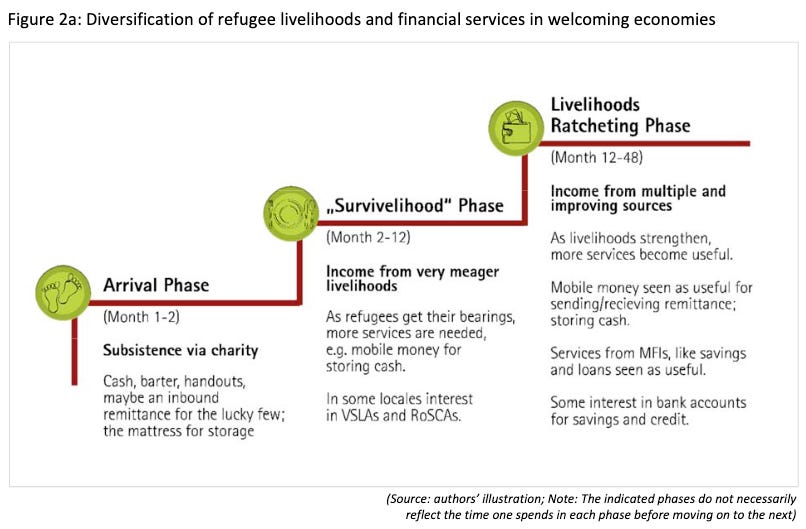

Finding #2: The need for and the uses of financial services co-evolve with progressions in the diversification of refugee livelihoods.

As refugees gain their bearings, learn new skills, and participate in the local economy, more uses for financial services emerge. (However, as mentioned above, when they cannot access work for lack of rights, the uptake of more financial services is stalled – permanently.)

- If refugees are allowed to participate in healthy economics, their livelihoods progress naturally and their financial service needs likewise evolve from, for example, handouts in the Arrival Phase, to loans and savings in the Survivelihood Phase, to leasing and insurance in the Livelihoods Ratcheting Phase.

- Removing obstacles to mainstream services may be far more effective strategies that urging users to adopt niche services.

Recommendations:

Municipal and national governments, as well as international donors and aid agencies, should make it easier for refugees to pursue their own goals through the following recommendations:

- Remove barriers to the ratcheting process, such as poor access to documentation. Provide local Help Desks to support displaced people in navigating documentation requirements.

- Smooth the way through expanded access to information and mentoring skill-building.

- Support refugee-led and religious organizations that often do the heavy lifting when it comes to new arrivals and long-term arrivals unable to survive without charity.

- Strengthen social networks and improve cross-cultural exchanges with members of the host population through services such as building urban community spaces to allow friendly meeting places for nationals and refugees; community gardening activities; business apprenticeships and mentoring programs.

- Include refugees in national social protection, education, and health programs.

Finding #3: Financial service providers need not create new services for refugees. Instead, they should adapt existing mainstream solutions that are popular with the host population by making necessary adjustments, such as language or documentation needs.

Fintech companies and bilateral and multilateral agencies are keen to pursue special products for displaced people, but these “solutions” are unnecessary. To make existing products and services relevant, supplies can adjust marketing materials and user interfaces.

- Refugees and migrants are not a “market” because they are not a homogeneous group defined by similar traits, customs, and preferences. Because of this population’s diversity, a supplier would need to develop a business case for each market subset, an expensive and defeating proposition.

- Refugees and migrants are not a segregated group either in camps or in urban areas. They continually interact with members of the host population and can see and observe the financial products their hosts use, which they too will want to use when ready.

Recommendations:

- State actors must ensure access to mainstream financial services by refugees of all nationalities. The private sector should improve its customer service, address complaints regarding handling procedures, and quickly redress grievances.

- Provide a clear regulatory framework that allows for the easing of Know Your Customer and customer due-diligence rules. A regulatory framework with a tiered, risk-based approach that balances proof of identity requirements with risks associated with terrorism and money laundering would be a good first step toward financial integration.

- Permit the use of alternative forms of government-issued refugee identification documents that are easy to access during initial registration and re-application.

- Eliminate refugee hierarchies based on countries of origin. Ensure access to all refugee nationalities.

Finding #4: The uncertainty of long-term prospects long-term prospects discourages refugee investment in skills and assets, limits self-reliance, and produces a permanent dependence on charity. Instead, they invest their energy in hoping for resettlement, a highly unlikely prospect for most.

Without the prospect of long-term solutions, very few refugees will invest in transferable skills, businesses, or property.

- Lack of long-term prospects leaves refugees trapped in the “survivelihood phase,” where they barely earn enough to survive, let alone grow their businesses or diversify their household incomes.

- If prospects for long-term residence increase, refugees are more likely to make livelihood investments, such as committing time to vocational training, and their financial health strengthens. They expand their planning horizons beyond their daily needs and into the future.

Recommendations:

- Host governments and the international community should join forces to reduce uncertainty for refugees by increasing long-term livelihood options while communicating those options with clear and consistent messaging.

Finding #5: Our “financial health” framework modified for refugees is useful for analyzing the role of financial services in people’s financial health. We found that financial services are only one contributing factor to financial health.

Refugees or migrants are ‘financially healthy’ when, over the course of four years beginning with their arrival, they are able to 1) Meet basic needs; 2) Comfortably manage debt; 3) Recover from financial setbacks; 4) Access lump sum to enable investment in assets and opportunities; and 5) Continually expand planning horizons.

- Financial services alone cannot produce economic outputs or financial health. A combination of factors, including legal frameworks and social norms, must come together to make financial services useful and powerful.

- Financial services are a contributing factor to financial health in conjunction with robustness of social networks, the quality of friendships, favorable family structures, access to good information, skills-building opportunities, educational opportunities, and the ability to work and to move freely.

Recommendations:

- Research and set benchmarks for refugee financial health, something that will require the combined efforts of practitioners, policymakers, and researchers.

- Combine financial services with livelihood support programs and financial planning services rather than standalone financial services.

Day 2: What the FINDings Reveal About our Assumptions

Day 2 consisted of four breakout sessions where panels of experts discussed the Key FINDings above, prompted by unique “key provocative statements” related to their own research, programming, and organizations.

Breakout Session 1, Key provocative statement: Responses by faith-based or refugee self-help organizations, though crucial, are impossible to scale.

In this breakout session, we explored the constraints facing community driven organizations (CDOs), as well as their best practices that may stand to be replicated and scaled by international agencies and larger NGOs. The session included a brief overview of our findings on the roles of CDOs in Jordan, Kenya, Mexico, and Uganda, in addition to the experiences of the panelists and the organizations they represent.

Watch the recording of Breakout Session 1 here.

Breakout Session 2, Key provocative statement: We just don’t know what works to support livelihoods and financial health for refugees and displaced populations?

This session featured an overview of existing evidence on livelihoods programming recently conducted by the Center of Global Development (CGD), as well as a discussion of the FIND research in Uganda, and International Rescue Committee’s (IRC) accompanying pilot programming based on research findings. The panelists engaged in a lively discussion on their experiences with livelihoods programming and research, what has worked and what hasn’t, unpacking how to support full financial health for refugees and brainstorming new areas for research and programming focused on financial health.

Watch the recording of Breakout Session 2 here.

Breakout Session 3, Key provocative statement: Why are digital financial services missing the mark in ratcheting up refugee livelihoods?

The session began with a presentation of the empirical FINDings from Jordan, discussing the role of digital financial services in supporting refugees to achieve their desired financial outcomes in Jordan, and their limits and risks, calling for a more innovative and joint effort. Examples of findings from other country contexts such as Kenya and Uganda were touched upon well. The panelists reflected on the findings and shared their experiences promoting digital financial services relevant for refugees, looking at structural and practical barriers for refugees’ financial inclusion.

Watch the recording of Breakout Session 3 here.

Breakout Session 4, Key Provocative Statement: Innovations in refugee services are at a standstill.

Especially since the onset of the Syrian refugee crisis, the enormity of the challenge of accommodating large flows of refugees has taken over headlines, consciousness, and domestic politics. Practitioners and technologists alike rushed headlong into developing what appeared to be new approaches to both policy and practice, experimenting with new ways to support host countries, deliver humanitarian assistance, and encourage refugees to build livelihoods in displacement. Panelists shared their experiences with a type of intervention that might be labelled “new” and reflected on what it achieved, where it fell short and why, and aspects of this kind of innovation that offer hope for expanded durable solutions for refugees in protracted displacement.

Watch the recording of Breakout Session 4 here.

You can find the full video recording of Day 2 here.

Fresh FINDings is made possible through a partnership among Tufts University, the Katholische Universität Eichstätt – Ingolstadt (Catholic University or KU), the International Rescue Committee and GIZ. Fresh FINDings also features work sponsored by Catholic Relief Services, Mercy Corps, and the International Organization for Migration.

Contact: Kimberley.Wilson@tufts.edu