Oil-Rich Kazakhstan Begins The Long March Towards Renewables

By Ariel Cohen, Alum of The Fletcher School of Law and Diplomacy at Tufts University

The massive 20%-spike in oil prices following the Abqaiq-Khurais attacks on Saudi Arabia’s oil production facilities has since completely evaporated. Brent crude peaked at $71.95 per barrel when markets reopened on Monday, September 16, but prices have now plummeted to $59.15 a barrel – 4% lower than before the attack. Global economic slowdown turned out to be a stronger factor than Iranian missiles and drones.

Severe oil market fluctuations like these are why certain fossil fuel-dependent countries are hedging bets, and accelerating their push to diversify away from hydrocarbon-based economies towards renewable energy generation.

Saudi Arabia, the oil market maker, announced ambitious plans to expand its renewable energy sector as a part of its 2030 Program. In 2018 alone, under the National Renewable Energy Program (NREP), Saudi Arabia has successfully launched two renewable energy projects in the northern region of Al-Jouf: Sakaka, a 300 MW solar PV powerplant,; and the Dumat Al-Jandal 400 MW onshore wind project.

Another country that sees the green future is Kazakhstan.

Home to 12th-largest oil reserves in the world, just behind the United States, Kazakhstan might seem to have low incentives to invest in diversifying away from hydrocarbons. Oil exports have been driving Kazakhstan’s economic development for almost three decades now. Oil production made up 30% of the country’s GDP in 2017 and scored almost 60% of the total export value in 2015.

With an impressive 40 year reserves-to-production (R/P) ratio for oil, 35 R/P for gas, and 150 R/P for coal, it comes as no surprise that fossil fuel sources dominate electricity generation. In fact, coal alone is responsible for covering more than 70% of the nation’s electricity demand, while renewable energy sources, excluding hydropower, represent less than 1 percent of the country’s energy mix.

Due to the established energy infrastructure and subsidized low electricity prices, it might be difficult to see the benefits of reshaping the country’s fossil fuel-oriented energy landscape. However, its leadership is future-looking, and recognizes the need to build the infrastructure and expertise for the energy transformation.

While Kazakhstan can afford to enjoy cheap electricity for decades, there are costs. In addition to economic vulnerability to volatile oil prices, a fossil fuel dominated energy profile risks some immense environmental problems for the population, and foreign investors may cringe from being associated with coal-based electricity.

With its aging inefficient Soviet-era energy infrastructure, Kazakhstan is the world’s 19th-largest contributor to greenhouse gas (GHG) emissions, reporting 14 metric tons per capita in 2014. Approximately 82% its emissions are attributed to the energy sector. No wonder, then, that citizens have voiced their frustrations over increasingly frequent instances of black snow in the winter.

To its credit, the Kazakhstani government realizes the need for cardinal changes in its energy profile. The first steps to reduce its hydrocarbon dependency date back to 2009, when Kazakhstan adopted a law to support renewable energy projects. In 2013, First President Nursultan Nazarbayev set an ambitious decarbonization goal of achieving 3% share of renewables in the domestic power generation mix by 2020, 30% by 2030, and 50% by 2050. This translates to 3000MW of renewable power, no small task.

2016 – 2017 was a wakeup call for Kazakhstan, as record low oil prices led to an economic slow-down posting just 1.1-1.2% GDP growth. Since then, the government is reinvigorating efforts to build up its renewable generation capacity: It ratified the Paris Agreement in November 2016 and committing to reduce carbon emissions by 15-25% below 1990 levels by 2030. In 2017, Kazakhstan hosted an international trade fair EXPO-2017 and set Future Energy as its theme, aiming to attract investors in its green energy projects.

Thus far, the vast portion of Kazakhstan’s green energy projects are financed by the European Bank for Reconstruction and Development (EBRD) which holds an almost $3 billion-value project portfolio in Kazakhstan. Last month, EBRD approved another $330 million to fund the second phase of its Kazakhstan Renewables Framework in partnership with the Green Climate Fund.

As of today, Kazakhstan has 65 active renewable energy facilities – 33 hydroelectric power plants, 19 solar power stations, 12 wind power stations and 1 biogas facility, – and plans to launch 50 more plants totaling 2,353 MW capacity in 2020.

While it is unclear whether Kazakhstan will achieve its short-term goal of 3% renewable energy share by 2020, it definitely has the potential to go green in the long run. Among other Central Asian countries, Kazakhstan is in a better position to develop a diverse mix of renewable sources given its (relatively) robust infrastructure and certain geographic advantages.

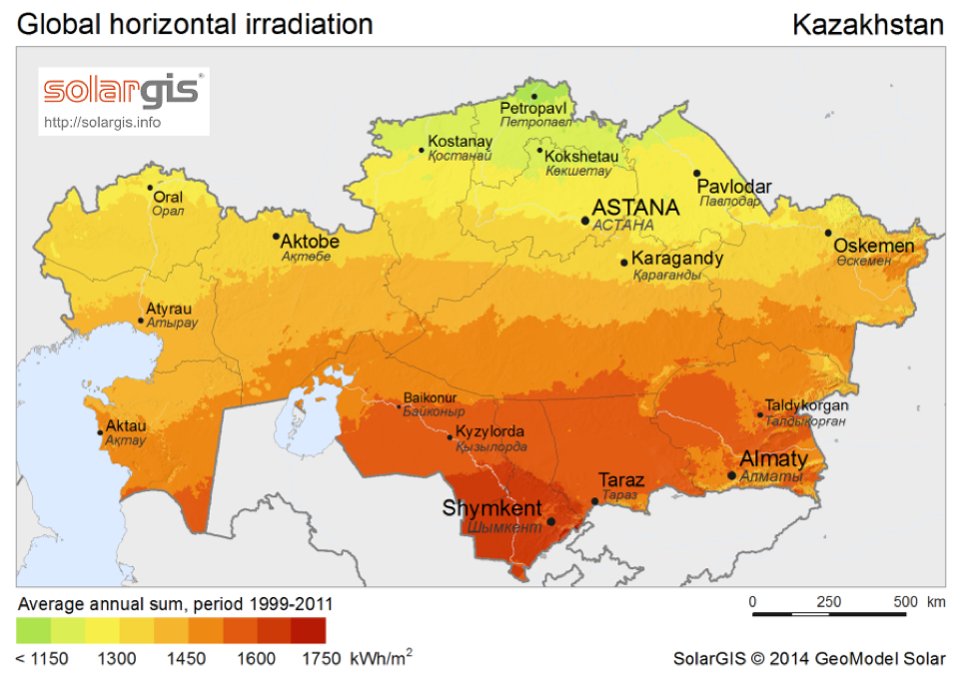

While hydropower leads among non-fossil fuel energy sources, Kazakhstan’s geography allows much greater prospects in solar and wind power. Endowed with 2,200 and 3,000 hours of sunlight per year, which can potentially yield 1,200–1,700 kW/m2 annually, the country is well suited for solar projects – particularly in its southernmost regions around Shymkent.

About 50% of Kazakhstan’s territory has average wind speeds of 4-6 meters per second (12-20 feet/second), making the Kazakh Steppe ideal for wind-capacity development.

To develop this promising potential, however, Kazakhstan will have to overcome significant challenges. Still developing transportation infrastructure stands in the way of moving large items, e.g. wind towers. Similarly, manufacturing contractors must deliver equipment that will function in extreme temperatures ranging from -50 to +50 Celsius (-58 F to +122 F).

Facing growing domestic electricity demand, aging Soviet-era energy infrastructure, and environmental and economic vulnerability, Kazakhstan is right to take the transition to renewables seriously. Large foreign investment into the renewable energy sources sector, improving hard infrastructure under the Belt and Road Initiative, as well as loud and clear signals of government’s commitment to its Green Economy program, will eventually bring more private businesses onboard. Recent developments and established targets suggest movement in the right direction. It is now up to the nation’s new President, Kassym-Jomart Tokayev, to follow through and expand upon the critical economic diversification plans set in motion by his predecessor.

This piece was republished from Forbes.