Russia Attempts To Take Over Venezuelan Oil, Creating A Challenge For The U.S.

By Ariel Cohen, Alum of The Fletcher School of Law and Diplomacy at Tufts University

A story in Venezuela’s El National newspaper is making the rounds in Russian media – reporting that Russian oil giant, Rosneft, is planning on taking over Venezuela’s National Oil Company PDVSA (Petróleos de Venezuela). In exchange, Russia is rumored to be offering debt relief to the struggling Latin American Country.

According to Russian business news outlet, VestiFinance, Russian experts have already visited Venezuela to evaluate the state of PDVSA and the possibility of a deal. There are rumors that any Russian takeover of Venezuela’s crown jewel would include a drastic reduction of the company’s staff – from 70 thousand employees to 35 thousand.

The prospects of a Russian buyout of Venezuela’s economic engine illustrates the dire state of the Chavista Regime’s economy and the hard-hitting impact of U.S. sanctions. But details beyond this are scarce. While Russian media outlets have reported positive reactions from Moscow, Rosneft and the government of Venezuela both continue to deny all knowledge of the potential takeover.

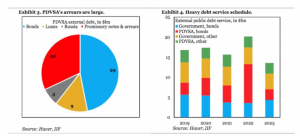

On the face of it, a potential Rosneft offer presents a rare opportunity for Venezuela to mitigate the damaging effects of sanctions and provide much needed debt relief for a country that owes over $156 billion to external parties. Thought of another way, Venezuela’s debt is some 740% higher than the value of its exports.

Rosneft is already active in Venezuela in joint projects with PDVSA, where it took significant minority stakes. But more importantly, these activities appear to not be in breach of U.S. sanctions, according to the U.S. Special Envoy for Venezuela Elliott Abrams. Despite this, Trump has been quite clear on his sanctions policy towards Venezuela (a maximum pressure strategy similar to Washington’s plans for Tehran). An attempt by Rosneft to liquidate and move PDVSA’s assets out of the purview of America’s sanctions regime has the potential to stir up retaliation in Washington. However, questions remain, including most notably how this exchange would affect Maduro’s most precarious debt to China, the country’s largest lender, with somewhere between $20-$60 billion in debt owned.

More Questions than Answers

On the surface, the Russian impetus for such a takeover is clear: to bring one of the world’s most prolific oil companies under the Kremlin’s control, further tightening the country’s grip on global oil markets.

As of 2016 estimates, PDVSA is worth approximately $186 billion. It also controls the country’s estimated 300 billion barrels of oil – the largest crude reserves on the planet – bigger than Saudi Aramco, albeit the Venezuelan heavy crude is dirtier and less desirable.

Bear in mind that the amount of PDVSA’s debt ($1.1 bn) doesn’t justify the full transfer of ownership nor does the amount of debt Venezuela owes to Russia as a whole ($17 bn). Nor does Russia have the cash ready to pay off Venezuela’s giant debt. China does, but Beijing seems not to be interested in a PDVSA takeover – its risk tolerance is lower than Moscow’s.

Furthermore, according to reports, Caracas reportedly wants to hand control over to Rosneft without having to go through privatization. However, without privatization, how would equity be defined?

It is also unclear how Rosneft would finance such an acquisition and who the owners would be – the majority government-owned Rosneft or another Russian state agency. Previous joint ventures between Russia and Venezuela had arrangements with PDVSA controlled by Rosneft on the Russian side. Because these structures already exist to some extent, it is likely that such an acquisition would be primarily managed by Rosneft and not another state agency.

Media reports have also mentioned that the sale of PDVSA would need to be greenlighted by the opposition-controlled National Assembly – currently headed by Juan Guaidó (who also claims to be the legitimate, constitutionally appointed leader of the Latin American nation). However Maduro’s takeover of Venezuela’s Supreme Tribunal of Justice in 2017 allows him to essentially sidestep the constitution and effectively ignore the powers granted to the country’s democratically elected legislative body. The court, packed with Maduro loyalists, would no doubt again assert power over the Assembly if Maduro backed the sale.

A Risky Move that could Force Retaliation in Washington

In August, Washington announced a freeze on all Venezuelan government assets in the United States, escalating an economic and diplomatic pressure campaign against the Latin American nation. Part of this sanctions package was an executive order protecting Citgo, whose bondholders and other parties were vying for possible asset seizure as a way to receive compensation from Venezuela for unpaid debts.

Because it is a U.S.-based company with considerable cash reserves and a going concern, Citgo is perhaps the most prominent of PDVSA’s assets. However, if PDVSA were to be sold to Russia’s Rosneft, it stands to reason that the company’s shares in the refiner would also transfer ownership – an unacceptable result for Guaidó — and the United States.

If – and it’s a big if — Rosneft receives control over PDVSA, it would mean debt and sanctions relief for Caracas, increased control over global oil reserves for Russia, and an emboldened Moscow-Caracas alliance. In short, it could spell another foreign policy setback for the Trump administration. If reports are to be believed, Rosneft’s risky move to acquire PDVSA would certainly lead to an escalation of tensions between Moscow and Washington.

This piece was republished from Forbes.