Geospatial Evaluation of Kazakhstan’s Dostyk-Moyinty Railroad Progress: Spring 2024

(Originally published by NGA Tearline)

By Wescott Yeaw, Laura Stahl, Natasha Wood, Belmin Avdic, Mahmoud Nofal, Niki Mandel, and National Geospatial-Intelligence Agency (Yeaw, Stahl, Wood, Avdic, and Nofal are graduate students at The Fletcher School.)

Overview

The Dostyk-Moyinty railway (DMR) is a rail line in eastern Kazakhstan connecting the Kazakh-China border crossing at Dostyk with the interior of Kazakhstan. It is a critical component of the larger Middle Corridor (MC) trade route linking Central Asia, China, Europe, and Russia. Kazakhstan is currently adding a second rail line to the DMR, which is projected to increase transit volume five times along the route.

On-time completion of the DMR indicates Kazakhstan’s commitment and ability to successfully execute MC infrastructure development and increase its role as a conduit for trade between the European Union (EU) and China. The DMR expansion will facilitate Chinese trade to Europe, Central Asia, and Russia, with policy implications for the United States by potentially complicating sanctions enforcement against Russia and aiding the expansion of Chinese influence in Central Asia and Europe.

Activity

Kazakhstan is currently undertaking a second line expansion of the DMR as part of its “Nurly Zhol” (Bright Path) infrastructure development project. Construction began on 17 November 2022, and is projected by the Kazakh government to end in the fourth quarter of 2025. Geospatial analysis confirms consistent, substantial progress on the rail line across several administrative districts despite minimal open press and business reporting. Construction is over halfway completed and is on pace to finish by Q4 2025.

Background

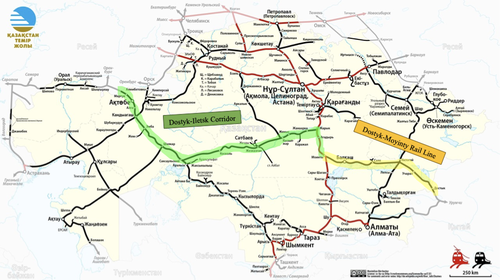

The development of a second rail line along the Dostyk-Moyinty railway (DMR) in Kazakhstan forms a crucial component of a broader initiative to modernize the Dostyk-Aktogay-Moyinty-Zharik-Zhezkazgan-Saksaulskaya-Kandyagash-Aktobe-Iletsk railway corridor which runs through a significant portion of Kazakhstan and links China to Russia. Figure 1 below shows the layout of the Kazakh rail network, with the DMR highlighted in yellow and terminating in the east at the Chinese border.

The DMR rail addition is entirely financed by Kazakhstan’s sovereign fund through the “Nurly Zhol” infrastructure development project, with construction undertaken by the national rail company Kazakhstan Temir Zholy (KTZ), according to the independent but government-linkedAstana Times. The second rail—spanning 836 km and including 419 engineering structures such as bridges and overpasses—began construction in November 2022 with a projected end date of fourth quarter 2025. The project aims to increase Kazakhstan’s trade capacity, as transit container export volumes have increased 2.2 times in the past five years and freight cargo between China and Kazakhstan was up 22% in January 2024 compared to January 2023. As previously noted, KTZ projects the second rail will increase DMR transit by a factor of five, from 12 to 60 freight train pairs a day.

By elevating train speeds and augmenting transport capacity, the second DMR line will better meet demand along the China-Europe transit route, which is central to global trade dynamics. Moreover, this modernization effort facilitates transnational commerce and advances regional economic integration, including regional trade with Russia. As such, the Dostyk-Moyinty railway development epitomizes Kazakhstan’s commitment to fortifying its transport infrastructure within the context of broader geopolitical and economic imperatives.

Methodology

This report uses open-source imagery, reporting, and public statements to analyze the construction progress and geopolitical significance of the second track of the DMR. Imagery was sourced from Maxar and Google Earth, while progress reports and shipment impact projections were gathered from railway industry magazines and official Kazakh government statements.

Railway Construction Process and Identifiers

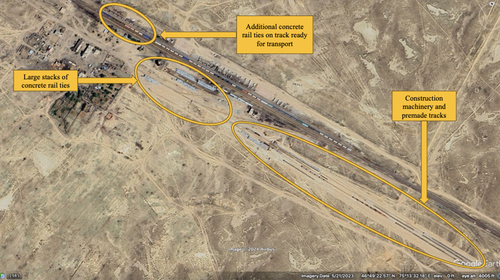

Agico Group, a railway supply company, notes that railway construction occurs in several phases: logistics, ground preparation, track laying, and ballasting. The first phase, logistics, requires gathering construction materials and equipment in large quantities near the railway site. This includes sand and gravel to prepare the ground and act as ballast, preconstructed rail, additional rail sleepers and tracks, and construction machinery. The sites at Sarikum and Orta Deresin, announced by KTZ as logistics hubs, show clear signs of expansion for DMR construction. See Figures 2a-b below, which show the Sarikum site, with expansions to the gravel and sand pits and new pre-constructed rail supply depots made between September 2021 and May 2023.

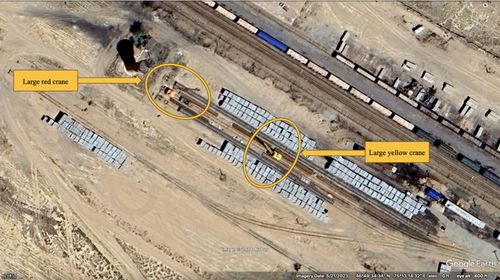

The Orta Deresin supply depot, about 84km east of Sarikum, serves as a major rail sleeper storage site. The concrete ties and premade rails are stacked in large lines along the railway, with transport cranes on temporary track to shift supplies onto the main rail line for laying. The premade rails and concrete ties are visible as large gray squares, with or without track attached, via satellite imagery; see Figures 3a-3c. These features have been confirmed by comparing them to ground photography of DMR construction sites released by the official KTZ Telegram channel; see Figures 3d-3e.

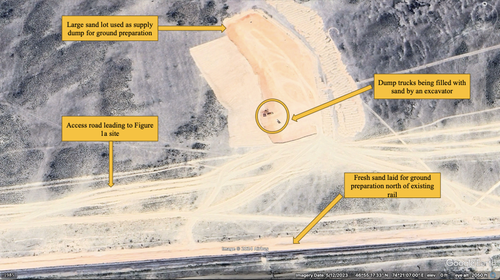

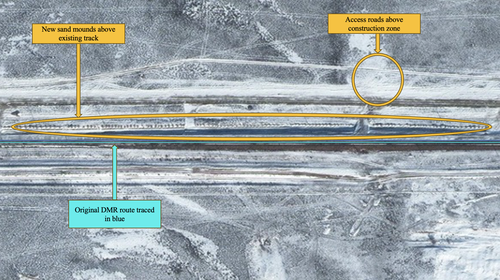

The second phase, ground preparation, involves laying and packing down a base layer of sand, which provides a stable and even base for the rail sleepers. Figure 4a shows ground preparation visible from Google Earth satellite imagery taken May 12, 2023. Notice the bright line of new sand north of the existing track, the roller vehicle used to compact and level the sand mounds, and the dump trucks on the access road north of the new rail ground carrying sand. Figure 4b, Google Earth imagery from May 18, 2023, shows a nearby sandlot and access road used by construction vehicles to gather and pour sand along the new railway.

Construction has continued despite winter snow. In Figures 5a-b below, which show a section of rail west of Sayak in January and April 2024, sand mounds and newly graded ground are visible. Trucks are pictured driving on the access roads. The image is not clear enough to determine whether a second track has now been laid, but there does not appear to be one. Given the absence of the sand piles and the continuing presence of mid-sized dump trucks, we can infer that this portion of the railway is still in the late stage of the initial ballast-laying process. We would expect to see sleepers and tracks being laid on this site shortly.

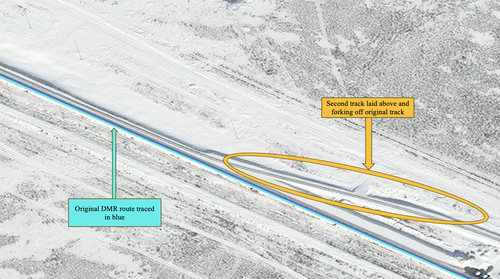

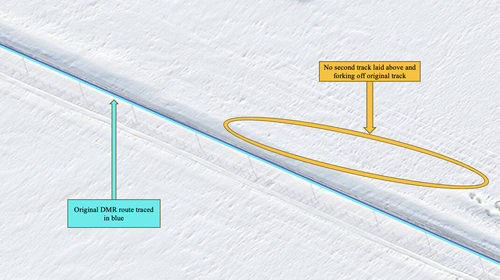

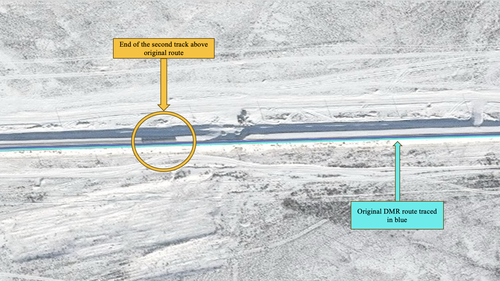

The final stages involve laying track on the prepared ground and weighing it down with gravel. This is easiest to spot on overhead imagery, as there is a clear second rail line running parallel to the original track. Figures 5c-d and 6 show areas near the towns of Sayak and Aktogay, between early January 2023 and late April 2024. These figures illustrate various steps of the track-building process, from grading to completion, and span multiple administrative districts. Common features of this imagery include heavy snow cover and low clouds, given the time of year in which they were captured, but tracks are still visible.

In Figure 5c below, Maxar imagery from January 17, 2024 clearly shows a new track forking off above the old line east of Sayak and west of the Karaganda/Jetisu border. For comparison, Figure 5d, the exact same location one year prior, features only one track.

Imagery and Analysis

Our analysis, based on imagery from late 2023 until May 2024, suggests, approximately 17.3% of new track has been laid along the length of the new DMR. Specifically, the imagery indicates new track is actively being added, and 33.4% of the route is undergoing ground preparation. Figure 6, created by the authors using imagery analysis, shows the portions of the rail with the original track in blue, new track laid in yellow, and ground preparation completed in red (magenta). KTZ’s official Telegram reports the track is being constructed at 14 different points simultaneously across the length of the route, to be connected at once, which is reflected in the imagery.

Development along the railroad is further advanced on the eastern end of the route. The railroad crosses three regions of Kazakhstan: Karaganda in the west, Jetisu in the east, and a small section of Abai region. Figure 7 shows the Karaganda portion of the railroad from Moyinty in the far west to Саяк (Sayak) has more sand preparation than track. Immediately east of the border between Karaganda and Jetisu imagery shows much more track has been laid.

The Kazakh Bureau of National Statistics indicates that the cost of all construction work carried out between January-April 2024 in Karaganda (86,758.9 million tenge) was more than twice that carried out in Jetisu during the same period (40,346.4 million tenge). However, Bureau of National Statistics data from Jetisu comparing year-over-year construction by volume in early 2024 was 226.4% of construction during the same period in 2023. Karaganda demonstrates a less significant (though still notable) year-over-year growth in construction of 149.1%.

These figures account for all construction, including railroad development. Karaganda has a more urban population than Jetisu (81.7% urban vs. 44.6% urban) and data reflecting higher construction costs in Karaganda may be due to higher numbers of other urban construction projects, in addition to the DMR. Ultimately, Figure 7 confirms that rail development in the eastern region of Jetisu has progressed faster than in the western region of Karaganda.

The imagery suggests that the process of prepping the rail line and laying sand is more time consuming than laying the track itself. Therefore, while only 17.3% of the track has been laid, it is reasonable to assume that the 33.4% of the track with sand laid will have track laid shortly. This assessment is based on visible trends—portions of track prepared with sand consistently have large stretches of track added on top shortly thereafter. As of writing, 50.7% of the route has either completed ground preparation or has track laid. Imagery indicates that the bulk of the work on the railroad has been done since mid-2023. If the remaining 50% of the route takes another 12-18 months to complete, we estimate that the DMR railway is on track for completion by Q4 2025, which is the current projected completion date. Major hurdles that would delay completion beyond 2025 include limited funding, political turmoil, and inclement weather.

Strategic Importance

The map in Figure 8 clearly shows Kazakhstan’s vital geo-strategic position in Central Asia between China, Europe, and Russia. Dostyk serves as a critical starting point for a vital trade corridor directly linking China, Kazakhstan, and Russia, and thus has major benefits for those countries.

Benefits to Kazakhstan

The DMR is key to Kazakhstan’s goal to increase its domestic and regional trade and thus bolster its power in Central Asia. Developing DMR infrastructure provides domestic jobs constructing rail and operating trains and boosts trade and business through greater regional connectivity. The new line’s anticipated 20 million ton capacity increase will be a significant boost to bilateral China-Kazakh trade. The faster, higher-capacity trade route also makes Kazakhstan a more attractive economic partner for both China and Russia, increasing its regional power in Central Asia while allowing Astana to balance between Beijing and Moscow. By reducing reliance on traditional trade routes through countries like Russia, Kazakhstan aims to leverage its strategic location and emerging transport infrastructure to become a central link between Europe and Asia.

Benefits to China

DMR expansion also benefits China. The new rail line enhances the Middle Corridor’s viability as an alternate China-Europe trade route by increasing transport capacity to meet rising demand for Chinese goods. Better DMR infrastructure helps China secure stable overland trade routes that are less susceptible to geopolitical disruptions or U.S. pressure. Successful DMR completion helps provide a more reliable and efficient trade route to Europe and strengthens China’s economic presence in Central Asia. DMR expansion also increases Chinese trade volume and provides access to emerging markets, expanding its economic and political influence, thus softening China’s image among those worried about its rise.

Benefits to Russia

While the DMR expansion has potential to boost China-Europe trade in the mid to long-term, it also boosts China-Russia trade in the short to mid-term. The DMR line serves as the access point for the Northern trade route from western China into Russia. According to PTC Operator, the company running the Dostyk terminal, transshipment through Dostyk of Chinese goods to Russia (and Russian goods to China) has increased since Russia invaded Ukraine. Raising transit capacity along the line would allow for further increases in China-Russia and Kazakh-Russia trade. Russia would thus have greater access to Kazakh and Chinese raw materials, machinery, and electronics exports.

Look Ahead

Based on the imagery collection outlined above, and on the projected completion date of Q4 2025 put forth by the Kazakh Ministry of Transportation and the involved officials, we are confident that the Dostyk-Moyinty railway extension will be completed within the government’s target time frame. The successful completion of this railway project will bolster Kazakhstan’s efforts to frame itself as a key transportation corridor between Europe, Russia, and China. It will also strengthen the trade relationship between China and Central Asia, allowing for significantly increased trade volume over this critical border crossing. In the current geopolitical moment, a Kazakhstan with stronger ties to China and the ability to frame itself — and function—as a strategic economic partner will give Almaty a more prominent role on the regional economic stage. If the Dostyk-Moyinty extension project carries through as we predict, Kazakhstan will be making good on its promise to solidify the infrastructure of the Middle Corridor.

Things to Watch

- Continue to monitor rail progress

- Look for open press completion and opening ceremony reports

(This post is republished from Tearline.)