Russian Politics in Putin’s New Term

By Chris Miller, Assistant Professor of International History at The Fletcher School of Law and Diplomacy at Tufts University

Russian President Vladimir Putin is the great survivor of European politics. Western leaders come and go, but Putin has persisted. He has managed to hold on to power for nearly two decades, through three foreign wars, two economic crises, multiple presidential and parliamentary elections (of varying degrees of fairness), a series of leadership reshuffles, the rise and fall of oil prices, and successive waves of economic sanctions. Among European leaders, he has been in power longer than anyone except Belarus’ dictator Alexander Lukashenko. Among world leaders, he is rivaled only by the presidents of Kazakhstan, Tajikistan, Cambodia, Samoa, and a bevy of African strongmen. One might think that, having survived for so long at the top of Russian politics, and having recently won a new term in office, giving him six more years as Russia’s president, Vladimir Putin might feel secure.

Yet there is reason to think that the next several years will present new challenges to the Kremlin – and that President Putin realizes at least some of the risks ahead. On the foreign policy front, Russia’s confrontation with the West looks unlikely to end soon. Russians’ hope that the election of Donald Trump as U.S. president would herald a major change in American policy toward Russia was mistaken. Nor does Europe’s approach toward Russia look likely to change soon. If anything, Russia looks likely to devote more attention and more resources on foreign policy over the next five years than during its recent past. Amid this backdrop of foreign pol- icy confrontation, the aftershocks of the 2014 crisis – when Russia was confronted both with an oil price crash and Western sanctions – are still being reverberating around Russian society at home.

Confrontation with the West

Donald Trump’s election as U.S. president surprised most analysts in Moscow but also created a sense of optimism that world events were moving Russia’s way. True, some Russian analysts pointed to what they described as longstanding Russophobia in American politics as constraining Washington’s willingness to compromise. Others noted that U.S. policy toward Russia is not only decided by the President, but also shaped by congress and by public opinion. But most Russian analysts believed that Trump’s election made far more likely U.S.-Russian deals on issues such as Ukraine, Syria, and sanctions – deals that would be made possible by U.S. concessions to Russia. None of this has materialized. In contrast to the president’s statements, his administration’s policies on Russia have been comparatively tough. The U.S. has given Russia no concessions on Ukraine or on sanctions, and its policies toward Syria look little different from those of the Obama Administration. There is no reason to expect that this will change. The U.S.-Russia confrontation is likely to persist, unless the Kremlin begins making unexpected concessions.

Russia’s relationship with Europe looks little better. After Trump’s election, many in Moscow staked bets on Marine Le Pen. The Kremlin feted her in Moscow before the first-round vote in the French presidential election. Though Le Pen made it into the run-off, she was roundly defeated by Emmanuel Macron, who has adopted a relatively tough policy toward Russia, driven in part by allegations that Russians hacked Macron’s campaign. Meanwhile, Angela Merkel, who devised Europe’s policy of sanctioning Russia and supporting Ukraine, has survived as German Chancellor. The attempted assassination of Sergei Skripal in the U.K. and ongoing revelations of Russian spying and hacking across Europe mean that EU sanctions on Russia are unlikely to be lifted soon.

Sanctions on Russia are more likely to be intensified than weakened. In the United States, Congress is set on punishing Russia for a range of sins. The perception that President Trump does not take seriously Russian meddling in U.S. elections has encouraged Congress to pass legislation obligating the administration to sanction Russia. Next up could be restrictions on Russia’s ability to is- sue sovereign debt. Thus far, only Russian corporations have faced restrictions on their ability to issue debt in U.S. and EU markets. Because the U.S. and the EU have the world’s deepest capital markets, this has all but prevented sanctioned Russian firms from issuing debt abroad.

Russia’s government, however, has not yet been touched directly – yet. The U.S. Congress is considering legislation that would change this. If passed, the legislation would make it extraordinarily difficult for Russia’s government to borrow abroad, forcing up the borrowing costs of Russia’s government and, by extension, Russian corporations, too. The Russian government has a low government debt level compared with most other countries, but Russian firms – including state- owned corporations such as Gazprom – have borrowed heavily abroad. They will face higher costs when they seek to borrow in the future. Yet borrow they must. Russian firms currently have over $300 billion in loans from abroad, which they must either regularly refinance or repay. If they were unable to refinance their loans, Russia’s economy would face a severe shock. Such a scenario, however, is unlikely. More likely is that Russian firms will have to pay more to borrow in the future, reducing their profits and their ability to invest. Estimates of the aggregate economic impact of restrictions on Russian sovereign debt issuance – including the secondary effects on corporate borrowing costs – vary, but there is little doubt that they would have a meaningful effect on Russian GDP growth and would probably force Russia’s government to increase taxes or reduce government spending.

The legacy of 2014

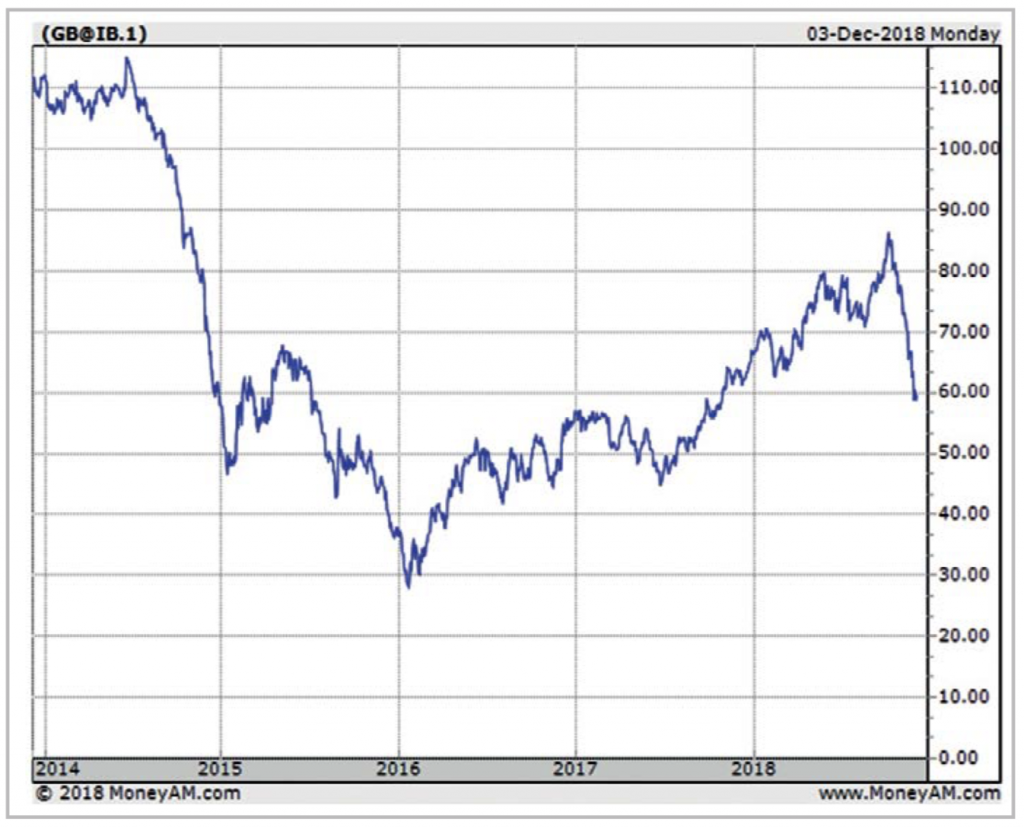

Increasing foreign policy tension comes as Russia is still dealing with the effects of the 2014-2015 economic crisis. When oil prices crashed and the West imposed the first round of financial sanctions in 2014, Russia’s economy fell into recession; the ruble fell by 50% against the dollar; and Russian’s inflation-adjusted wages fell by around 10%. Since then, however, Russia’s economy has returned to growth, and inflation has fallen from double-digit rates to around 3%, among the lowest levels recorded in modern Russian history.

Yet it would be wrong to conclude that Russia has fully recovered from the 2014 crash. In fact, the economic and political costs of the crisis are only now becoming clear. In the West, the knock-on effects of the 2008-2009 financial crisis are still being felt a decade later. Consider the Greek debt crisis, which was sparked by the global financial crash, but which did not itself peak until several years after the global crisis had subsided. In political terms, the aftershocks of the 2008 crash are still being felt, with many analysts attributing the success of populist political movements in the U.S. and Europe to the effects of the economic crisis.

In Russia, the economic effects of the 2014 crisis, while they were felt immediately, some of the economic pain has been building up, and will only be felt in coming years. One mechanism for this was via Russia’s financial system. After 2014, when Russia’s largest banks were placed under Western financial sanctions, Moscow let several smaller banks, including Otkritie and B&N Bank grow rapidly as part of an implicit strategy to ensure that credit kept flowing even amid the economic shock. Yet these banks had little effective oversight and lent and invested poorly. Since the beginning of the year, these two banks and others like them have collapsed, necessitating a government bailout, the costs of which will reach in the tens of billions of dollars, adding to the government’s debt. A second mechanism by which crisis-era pain was stored up for the future was via regional governments. They, too, borrowed heavily in recent years, and many are highly indebted. They will either need vast tax increases, spending cuts, or bailouts by the central government to stay solvent.

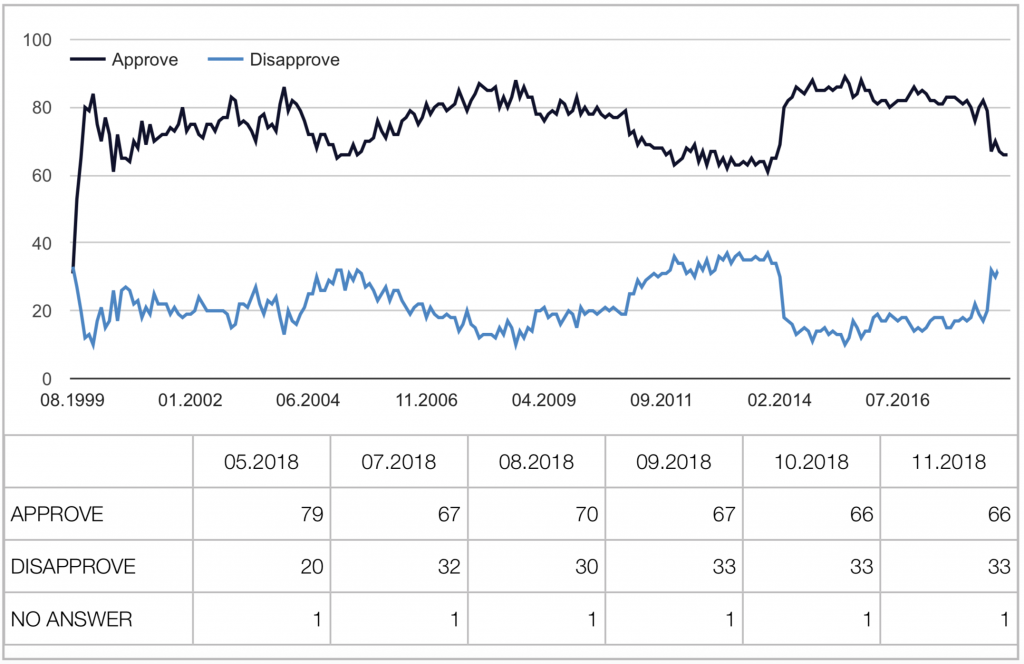

Ultimately, however, the costs of bailing out Russia’s banks – and potentially its regional governments as well – will be manageable for the Kremlin. More worrisome are the political aftershocks of the 2014 crisis. Putin’s popularity rating was sky-high throughout 2015 and 2016, even as Russia’s inflation rate spiked and inflation- adjusted wages collapsed. The Russian President sailed through reelection in the March vote, accumulating 76% of the vote – in large part by ensuring he faced no serious opposition candidates.

Yet polls suggest Russians want change, even if they cannot define what type of change they want. Recent elections have not gone the Kremlin’s way. In September, races for regional governorships were unexpectedly forced into runoffs. And Putin’s own popularity rating has sunk to around 70%, the lowest level since Crimea was annexed, according to the independent pollsters at Levada Center. The West has suffered political aftershocks stemming from the 2008 crash more than a decade after the economic low point. The political aftershocks of 2014 in Russia may be just beginning.

Is the Kremlin losing its touch?

The risk of aftershocks from the 2014 crash comes amid increasing speculation that the Kremlin is losing its domestic political touch. Since the annexation of Crimea, the Kremlin has benefited from a skillfully executed domestic campaign to paint Putin as a tsar who has restored Russian greatness, and to paint his opponents as fifth-columnists seeking to undermine Russia. All of Russia’s problems, it was argued, were caused by Russia’s opponents in the West, or by a tiny minority of oppositionist Russians who collaborated with Russia’s enemies. This rhetoric proved powerful in Russian domestic politics, undergirding Putin’s popularity during a challenging time.

Yet there are two reasons to think the Kremlin’s political skill might be declining. One reason is that, after 20 years in power, Russian leaders are increasingly out of touch with how average Russians think.

Given that they have few interactions with typical Russians and few occasions on which they must consider the views of average Russians, this is perhaps not surprising. True, the Kremlin has been trying to develop a new cadre of younger, more technocratic officials to serve in the presidential administration, and as regional governors. But the most powerful people in Russia were also the most powerful people a decade ago. The president’s closest advisers, so far as outside observers can tell, all have a similar worldview, and are all similarly cut off from broader trends in Russian society.

This isolation from Russian society may explain the second reason to think that the Russian government’s talent for domestic politics is declining: their recent decisions are highly unpopular. Since Putin’s reelection, Russia’s government has increased the value-added tax, adding to the price of nearly every good. More controversially, it has announced plans to raise the age at which Russians receive old-age pensions, sparking sizeable protests. These steps toward austerity have occurred despite that Russia’s government budget is currently balanced – meaning that there was no obvious need for spending cuts or tax hikes. True, Russia’s pension system, which currently has very low retirement ages, will become increasingly costly over the long run. But there was no immediate financial need to hike the pension age. The decision to do so, and to phase in the changes quickly, have sparked popular anger.

Conclusions

The combination of these three factors – ongoing foreign policy confrontation, aftershocks of the economic crisis, and increasingly volatile domestic political management – suggest that Vladimir Putin’s current term in office will be more complicated than his last one. The Kremlin probably thought that the past several years, which involved the annexation of Crimea, a multifaceted war with Ukraine, and a large-scale military intervention in Syria, were complicated enough. Yet none of these challenges are going away. Russia’s leaders will need to continue managing a complicated foreign policy agenda, even as they face more domestic dissent than at any point since the anti-Putin protests of 2011–2012. Vladimir Putin has proven himself skilled at surviving shocks both foreign and domestic. He will need all this skill and more to survive his six years as Russia’s president.

This piece was republished from Lithuanian Foreign Policy Review.