The Venezuela Oil Tariff Tests Trump Policies

By Ariel Cohen, Fletcher Alum and Senior Fellow at Atlantic Council

Today, disparate Trump policies —more muscular American diplomacy, less soft power, higher tariffs, and the quest for cheap energy — are being tested together in Venezuela. The pro-Russia, pro-China, and pro-Iran far left Maduro regime in Caracas has long been a thorn in the side of the United States in the often-neglected Latin American theater.

The first Trump Administration focused heavily on applying pressure to the country to minimize its benefits from oil exports in the U.S. American economy. Now, early in President Trump’s second term, he is reviving efforts to weaken the Chavista dictatorship by imposing secondary tariffs of 25% on all imports from countries that buy Venezuelan oil, starting on April 2nd. Additionally, on March 29th, the U.S. informed foreign partners of Venezuela’s state-owned oil company, Petroleos de Venezuela (PVDSA), that it plans to revoke authorizations issued by the Biden Administration for them to export Venezuelan oil and byproducts, putting further pressure on Venezuela’s ability to export.

While such measures will have certainly gotten Venezuelan President Nicolás Maduro’s attention, targeting that country’s most profitable industry may be insufficient to implement the president’s agenda.

A Split Global Strategy

Though Trump’s March 24th announcement of these tariffs follows on earlier proclamations about Venezuela sending criminals and gang members to the U.S., his Truth Social post concerning the measure cites that country’s opposition to the U.S. and the freedoms Caracas violates as motivation. Given the isolationist impulses that underpin many of the president’s foreign policy actions since taking office, American adversaries are getting mixed messages.

The most stark example lies in the approach the administration has taken toward Ukraine, prioritizing putting a stop to conflict rather than ensuring that Russia’s belligerent actions during the invasion are punished and anti-democratic messaging across Europe is countered.

Several U.S. programs promoting the values of democracy and freedom, such as Radio Liberty, Radio Free Asia, Radio Marti, and others, have had their funding halted (Radio Liberty’s funding was restored). These cuts will impact America’s ability to advance democratic efforts worldwide and weaken authoritarian regimes like Maduro’s.

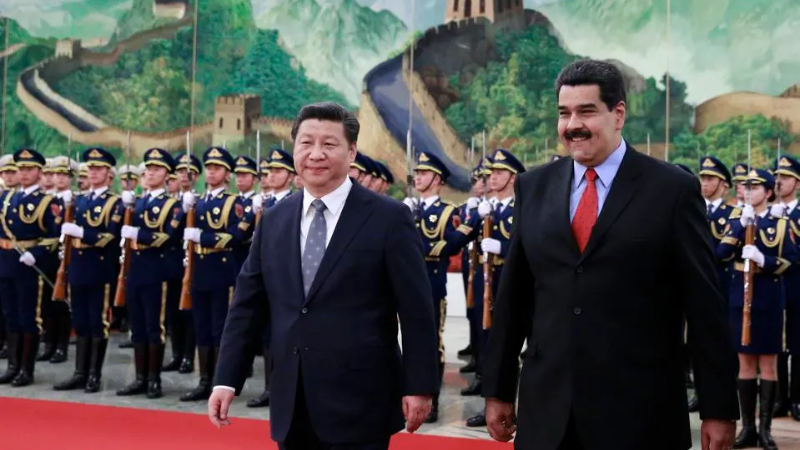

China’s Growing Foothold in Latin America

China, as Venezuela’s largest oil buyer, is poised to be impacted directly by these latest tariffs. The penalties would be applied in addition to tariffs already levied against China, putting it in a difficult position as it weighs whether to divest from Venezuelan oil, which makes up less than one percent of imports but represents a key part of the Chinese-Venezuelan relationship.

However, longer-term strategic considerations may outweigh the immediate economic pressure on China for suspending its oil trade with Venezuela. As other countries stop buying from Caracas, the country’s dependence on China as a customer may increase, providing Beijing with more leverage over pricing and Venezuelan policy.

A closer trade relationship with Venezuela would solidify China’s position as an indispensable partner, further enhancing its already growing soft power and presence in the region. As figures in the Trump administration like Secretary of State Marco Rubio decry China’s growing influence in Latin America, the tariffs going into effect in April may have the unintended consequence of strengthening Beijing’s position.

Handing Canada a Win

These tariffs could also hinder the efforts of the Trump Administration as it pursues similar measures against other exporters, particularly Canada. At the outset of his second term, Trump quickly got to work levying tariffs against the U.S.’s northern neighbor, with a current rate of 25% on all Canadian goods, except for oil and gas exports, which are taxed at a reduced rate of 10%. Even the reduced tariff on these resources causes alarm in Canada, as the U.S. is the country’s largest market.

American tariffs on countries trading with Venezuela are likely to prompt current consumers of Venezuelan oil to seek alternative suppliers. Analysts have already predicted that China and India could look to Russia as an alternative supplier, hardly a win for America. Canada could fulfill a similar role of an alternative exporter, as tariffs on Canadian energy, including its heavy oil, which is similar to Venezuela’s, are already in force, and the United States has already proven discriminatory in energy trade with Ottawa before and after the first Trump Administration, as demonstrated by the persistent delays and eventual cancellation of the Keystone XL pipeline by the Obama and the Biden Administrations.

The Trump administration’s attitude toward Venezuela has remained consistent across the President’s two terms. However, by ratcheting up the pressure on Caracas by choking off its oil sales, the Trump White House risks strengthening China’s strategic foothold in Latin America and Canada’s economic position. Punishing Caracas makes sense, but so does the traditional U.S. promotion of democracy, human rights, and freedom of speech, commodities the Maduro regime sorely lacks.

(This post is republished from Forbes.)