The Anti-Dollar Axis: Russia and China’s Plans to Evade U.S. Economic Power

By Mihaela Papa, Adjunct Assistant Professor at The Fletcher School, and Zongyuan Zoe Liu, Political Economist

Russian forces are now seizing territory across Ukraine, shelling military and civilian targets, and creeping closer to capturing the capital, Kyiv. The international response to Russian President Vladimir Putin’s invasion has been furious, and U.S. allies are united against the invasion. U.S. President Joe Biden has led the international community in slapping punitive sanctions on Russian elites and firms with the intention of crippling the Russian economy and forcing a change of course. But so far, these measures have failed to compel Russia to accept a cease-fire or to withdraw.

The war is barely ten days old, and it remains to be seen what Putin will do if and when sanctions stoke greater public discontent in Russia. But these punitive sanctions may also backfire in another way. Biden’s flexing of American economic muscle will only embolden Russia and other U.S. rivals, notably China, to deprive the United States of the very power that makes sanctions so devastating. Russia and China will expedite initiatives to “de-dollarize” their economies, building alternative financial institutions and structures that both protect themselves from sanctions and threaten the U.S. dollar’s status as the world’s dominant currency. Without concerted action, the United States will struggle to reverse this movement and see the weakening of its global standing.

The U.S. dollar’s preeminence in the global financial system, backed by vibrant U.S. markets and unmatched U.S. military strength, makes any sanctions imposed by Washington formidable. No other currencies, the euro and the yuan included, have come close to dethroning the dollar from its primary position in the global economy and in international financial markets. The dollar is the most widely held reserve currency in the world. It is the main invoicing currency in international trade and the leading currency across global financial institutions. It dominates global equity markets, commodities markets, development finance, bank deposits, and global corporate borrowing. In times of crisis, people around the world turn to the dollar as their first choice of a safe-haven currency. U.S. sanctions effectively amputate the financial power of a foreign aggressor, preventing it from raising capital in global markets to bankroll its activities.

Russia might be the most outspoken champion of throwing off the yoke of the dollar, but its agenda has great appeal among major powers. China’s commitment to diversifying its foreign exchange reserves, encouraging more transactions in yuan, and reforming the global currency system through changes in the International Monetary Fund further buttresses Russia’s strategy. Deteriorating U.S.-Chinese relations incentivize Beijing to join with Moscow in building a credible global financial system that excludes the United States. Such a system will attract countries under U.S. sanctions. It would even appeal to major U.S. allies who hope to promote their own currencies to the detriment of the dollar. When imposing sanctions, the Biden administration must not just consider how these measures will shape the war in Ukraine but also how they might transform the global financial system.

THE DOLLAR YOKE

For at least a decade, Russian policymakers have been wary of the preeminence of the dollar. In 2012, Russian Deputy Foreign Minister Sergei Ryabkov expressed Russia’s concern about the dollar’s dominance in international trade. After the annexation of Crimea in 2014, the Obama administration expanded sanctions on Russia that targeted several large Russian banks, as well as energy companies, defense corporations, and wealthy supporters of Putin. The Russian government subsequently launched two critical pieces of financial infrastructure to fend off sanctions and preserve its financial autonomy if cut off from the Society for Worldwide Interbank Financial Telecommunication system, also known as SWIFT, which allows banks to send messages to one another. One was an independent national payment system that worked as a Russian alternative to payment platforms such as Visa and Mastercard. The other was a proprietary financial messaging system called the System for Transfer of Financial Messages, or SPFS, the Russian version of SWIFT.

SPFS became fully operational in 2017, transmitting transaction messages in any currency. In December 2021, it had 38 foreign participants from nine countries. As of this March, SPFS has over 399 users, including more than 20 Belarusian banks, the Armenian Arshidbank, and the Kyrgyz Bank of Asia. Subsidiaries of large Russian banks in Germany and Switzerland, the two most important financial power hubs in Europe, have access to SPFS. Russia is currently negotiating with China to join the system. This alternative financial infrastructure enables Russian corporations and individuals to retain some access, albeit limited, to global markets despite sanctions.

Since 2018, the Bank of Russia has also substantially reduced the share of dollars in Russia’s foreign exchange reserves with purchases of gold, euros, and yuan. It also withdrew much of its reserves from U.S. Treasury bonds; between March and May 2018, the Bank of Russia reduced its holdings of U.S. Treasury securities from $96.1 billion to $14.9 billion. In early 2019, the bank cut its U.S. dollar holdings by $101 billion, over half of its existing assets. In 2021, after the Biden administration imposed new sanctions on Moscow, Russia announced its decision to completely remove dollar assets from its $186 billion National Wealth Fund, a major sovereign wealth fund.

Since the beginning of his fourth presidential term in 2018, Putin pledged to defend Russia’s economic sovereignty against U.S. sanctions and prioritized policies that steered the country’s economy away from the dollar. He advocated for getting “free” of the dollar “burden” in the global oil trade and the Russian economy because the monopoly of the U.S. dollar was “unreliable” and “dangerous.” In October 2018, the Putin administration supported a plan designed to limit Russia’s exposure to future U.S. sanctions by using alternative currencies in international transactions. Since then, major Russian energy companies have stopped using the U.S. dollar. Gazprom Neft, Russia’s third-largest oil producer, sold all of its exports to China using yuan in 2015. Rosneft, Russia’s largest oil and gas company, switched all export contracts from U.S. dollars to euros in 2019. The euro has already replaced the dollar as the primary vehicle of trade between China and Russia. Data from the Bank of Russia reveals that by the end of 2020, more than 83 percent of Russian exports to China were settled in euros. Last month, Russia and China signed a 30-year contract in which they agreed to use euros in gas sales related to a new pipeline linking the countries that will become operational in the next two to three years.

Russia is currently preparing to launch a state-backed cryptocurrency that can get around the dollar. Sanctioned Russian entities can trade directly with anybody willing to accept the digital ruble without first converting it into dollars, thereby completely bypassing the dollar-based system. According to a 2020 Bank of Russia consultation paper on the digital ruble, the government would invite non-banking financial institutions, such as exchanges and credit institutions, to join the digital ruble network. This setup could provide Russian banks with an alternative source of access to international liquidity and decrease their vulnerability to sanctions.

A GROWING COALITION

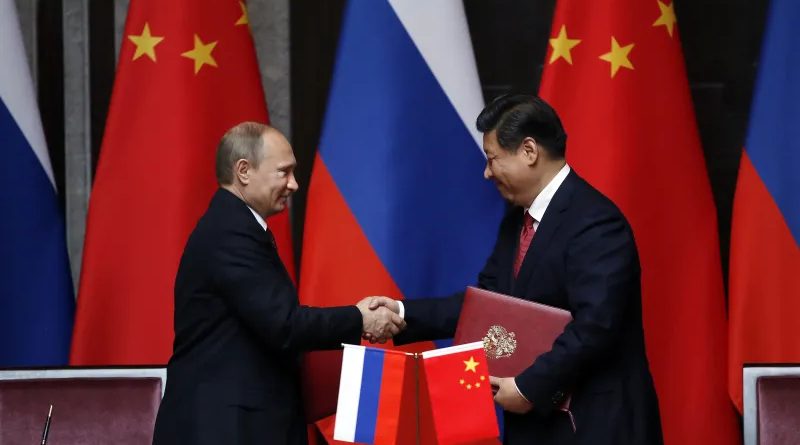

Russia’s unilateral initiatives to escape the hold of the dollar may be defensive in nature, but it has also worked with other countries to chip away at the dollar’s dominance. These coalitions present a long-term threat to the dollar’s preeminent role in international commerce and, consequently, a challenge to U.S. global leadership. The shared desire to reduce dependence on the dollar has strengthened the relationship between Russia and China. Bilateral currency swaps between the two central banks helped Russia bypass U.S. sanctions in 2014 and facilitate bilateral trade and investment. In 2016, Prime Minister Dmitry Medvedev called for harmonizing the two countries’ national payment systems and discussed the prospect of launching a new Russia-China cross-border payment system for direct settlements in yuan and rubles. In 2018, Putin stated that Russia and China “confirmed their interest in using national currencies more actively in reciprocal payments.”

In 2019, China upgraded its ties with Russia to a “comprehensive strategic partnership of coordination for a new era,” the highest level of China’s bilateral relations. Thereafter, Russia’s central bank invested $44 billion in yuan, increasing its share in Russia’s foreign exchange reserves from five to 15 percent in early 2019. Russia’s yuan holdings are about ten times the global average and account for nearly a quarter of global yuan reserves. In 2019, China and Russia signed a treaty that increases the use of their respective national currencies in cross-border trade to 50 percent. In 2021, Russian Foreign Minister Sergei Lavrov urged China to work with Russia to reduce their dependence on the U.S. dollar and Western payment systems. The Russian government allowed Russia’s sovereign wealth fund to invest in yuan reserves and Chinese state bonds. Chinese policymakers hope that partnership with Russia will help broaden a yuan-based financial infrastructure, including a Chinese rival to SWIFT and a rival bank card payment system, thereby boosting the yuan’s status as a reserve currency and bolstering China’s financial autonomy.

Putin seeks to expand such alternative financial infrastructure through Russia’s dealings with other countries. In 2019, Iran and Russia connected their financial messaging systems, thereby bypassing SWIFT by allowing banks in both countries to send cross-border transaction messages. Russia and Turkey have discussed using the ruble and the Turkish lira in cross-border trade. Russia introduced its version of SWIFT to banks in the Eurasian Economic Union (a partnership of five post-Soviet states) and expressed interest in expanding it to countries in the Arab world and Europe. Russia has tried to muster further support for de-dollarization in multilateral forums such as the BRICS grouping, which consists of Brazil, China, India, Russia, and South Africa, and the Shanghai Cooperation Organization. BRICS’ New Development Bank has raised funds in local currencies as part of its goal to “break away from the tyranny of hard currencies.” In 2020, SCO members underscored the importance of using national currencies in trade among one another and discussed the establishment of a development bank and development fund. Russia and China can use these forums to create a broad de-dollarization coalition with the promise of greater financial autonomy for all and reduced dependence on the dollar.

REINFORCING THE DOLLAR

The Biden administration must consider this broader context as it determines how best to pressure Russia to withdraw from Ukraine. Additional stringent sanctions against Russia could help Ukraine in the short term but risk accelerating a broader de-dollarization movement that could in the long term fundamentally weaken U.S. global leadership. The United States should strengthen the U.S. dollar-based global financial system if it wants to preserve the foundation of U.S. hegemonic power and sustain the dollar’s service as a stable public good indispensable for global financial stability. The Biden administration can preserve the dollar’s global preeminence by easing tensions with China and encouraging China to use SWIFT rather than switching to alternative systems. The United States should not implement policies that would lead to financial decoupling with China. U.S. financial regulators should respond to the request from their Chinese counterparts to strengthen communication and cooperation on market regulations. U.S. officials should also encourage more Chinese firms to list on U.S. equity markets, which would incentivize China to support the stability of dollar-based global financial markets.

The United States should weaken Russia’s core financial strength: the revenues it generates through oil and gas exports. U.S. energy cooperation with Europe is crucial to reducing the EU’s dependence on Russian energy. To achieve this, the Biden administration should in the short term provide alternative energy supplies to its allies in Europe and the Asia-Pacific region. In the medium to long term, the United States should also work with its allies to counter Russia’s nuclear power exports. Russia’s absolute dominance in the global nuclear energy exports market (it has 60 percent market share) lets it weaponize its control over nuclear power technology and fuel supplies in times of geopolitical tensions. Congress should strengthen the ability of the Export-Import Bank of the United States to develop innovative public-private partnerships and provide more financial support to U.S. corporations in the nuclear energy exports market.

Congress should also empower the Development Finance Corporation, the U.S. government’s development finance institution, to become a credible source of capital for emerging markets and lower- and middle-income countries. Development finance is an important but underutilized tool of economic statecraft. Russia has attempted to advance de-dollarization efforts through multilateral development institutions, and the United States must respond. Washington should raise the profile of the DFC and work with the development finance institutions of U.S. allies, such as the Japan Bank for International Corporation, to strengthen the role of the dollar and U.S. leadership in international development finance.

A strong U.S. economy is the most effective and credible tool for countering adversaries seeking to undermine confidence in the dollar. Countries and companies comply with U.S. sanctions because they seek to retain access to U.S. markets, to the U.S. dollar, and to the broader U.S.-led global system. The U.S. government should be aware of the unintended consequences of its sanctions policy and find ways to undermine Russia and China’s de-dollarization partnership. If Washington fails to act, it will be in effect choosing to discard the mantle of its global leadership.

This piece was re-published from Foreign Affairs.