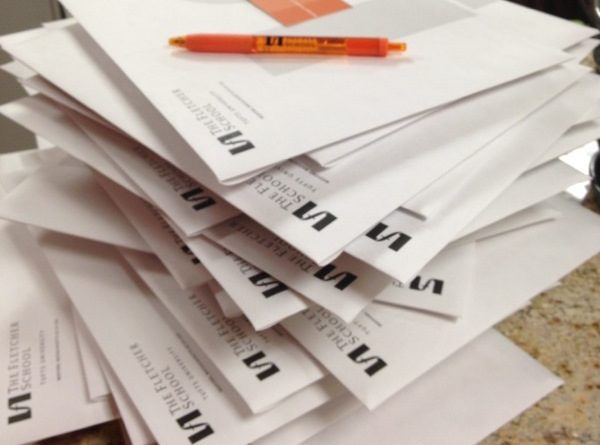

Now that you’ve submitted your application…

It’s Monday after the application deadline, which means a big thanks to all of you who recently submitted applications for fall 2020 enrollment. We’re grateful for the work you put in to meet our deadlines, and you should feel entitled to take a bit of a breather for a few days. Crack open that book you got for Christmas that you haven’t gotten to yet but know you’ll have to talk about with your well-meaning relative. Or binge The Mandalorian. Seriously, 40-ish minute episodes, Werner Herzog, baby Yoda…perfect for a quick diversion!

I bring up these side pursuits because, as I mentioned in a post last week, we’ll need a bit of time to process application materials and make updates to your Application Status page, so now’s a great time to catch up on whatever you’ve sidelined recently in order to work on your application. I realize that a lot of people hate waiting, though, so if you’re itching to keep up your grad school-related momentum, may I suggest now as an ideal time to begin (or, hopefully, continue) to work seriously on your financial plan? It’s an extremely important part of getting yourself to school, and just because you don’t yet have your decision or scholarship details is no reason not to get going on other matters; the large majority of Fletcher awards are partial scholarships, so most applicants will need to draw upon a variety of other financial resources to meet the cost of attendance. This is a good place to start researching possible external funding opportunities (scroll down to the accordion menus), most of which have varying application requirements and time frames. Are you planning to work part-time on campus? A few back-of-the-envelope calculations can give you a good sense of about how much you might realistically earn during a semester (many campus jobs will be in the range of 10-12 hours/week at $12-$15/hour), which can also help you determine what amount of educational loan funding you may need to pursue. Speaking of educational loans…it’s not too early to familiarize yourself with the FAFSA, if you’re eligible for US federal educational loans. Non-Americans might want to turn to our friend Madhuri, who offers some financial planning tips for international students, as well as investigate MPower Financing or Prodigy Finance, two options for educational loans that don’t require US-based co-signers.

All of a sudden this is sounding like homework, I know, but this kind of stuff is much better spread out over weeks and months than done in a frenzy over a few days. By the time admissions decisions and scholarship awards are available, you could have a lot of important financial details at your disposal, leaving more time to focus on your enrollment decision. In the meantime, our office will be in touch as soon as possible with application updates!